3 Drive Pattern

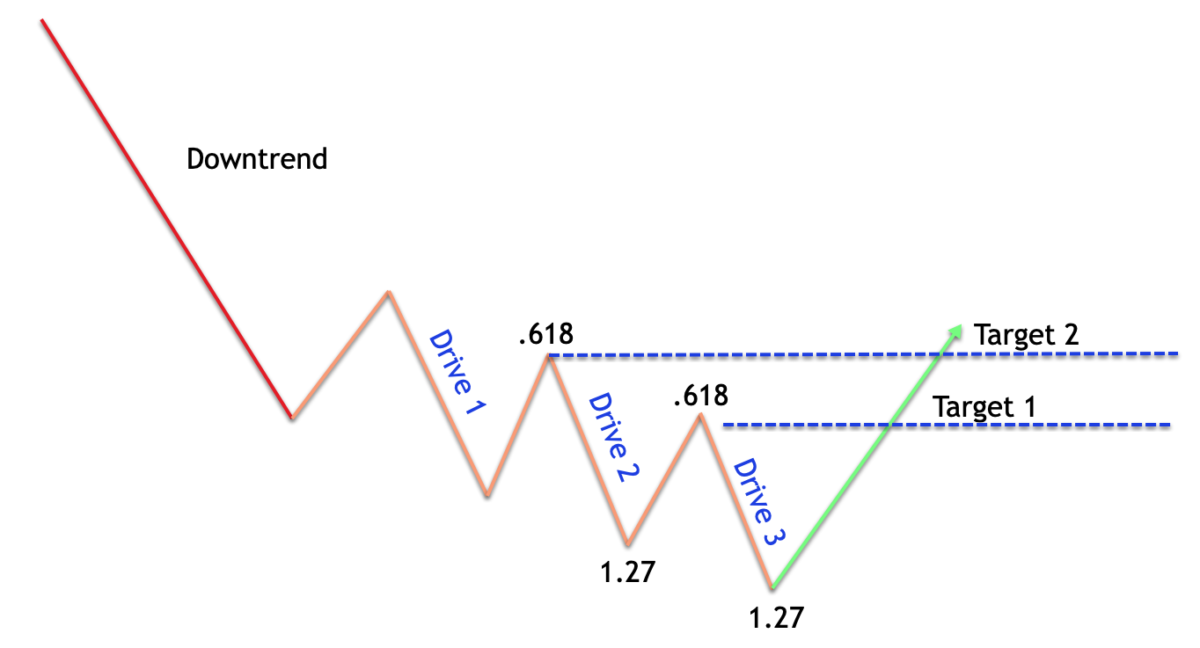

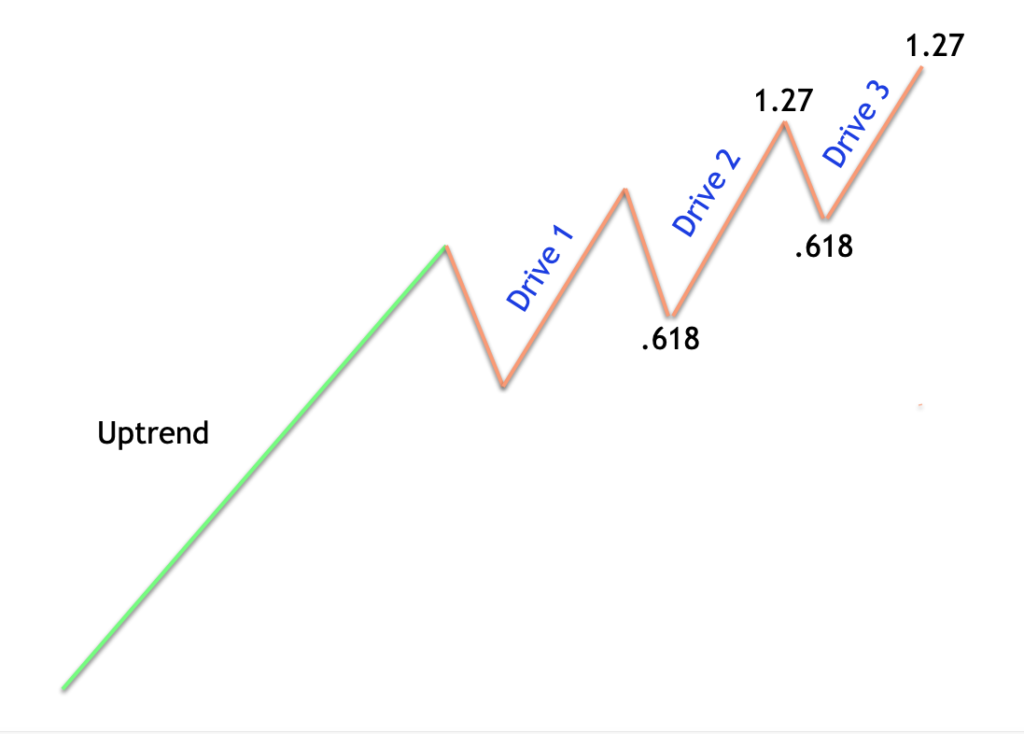

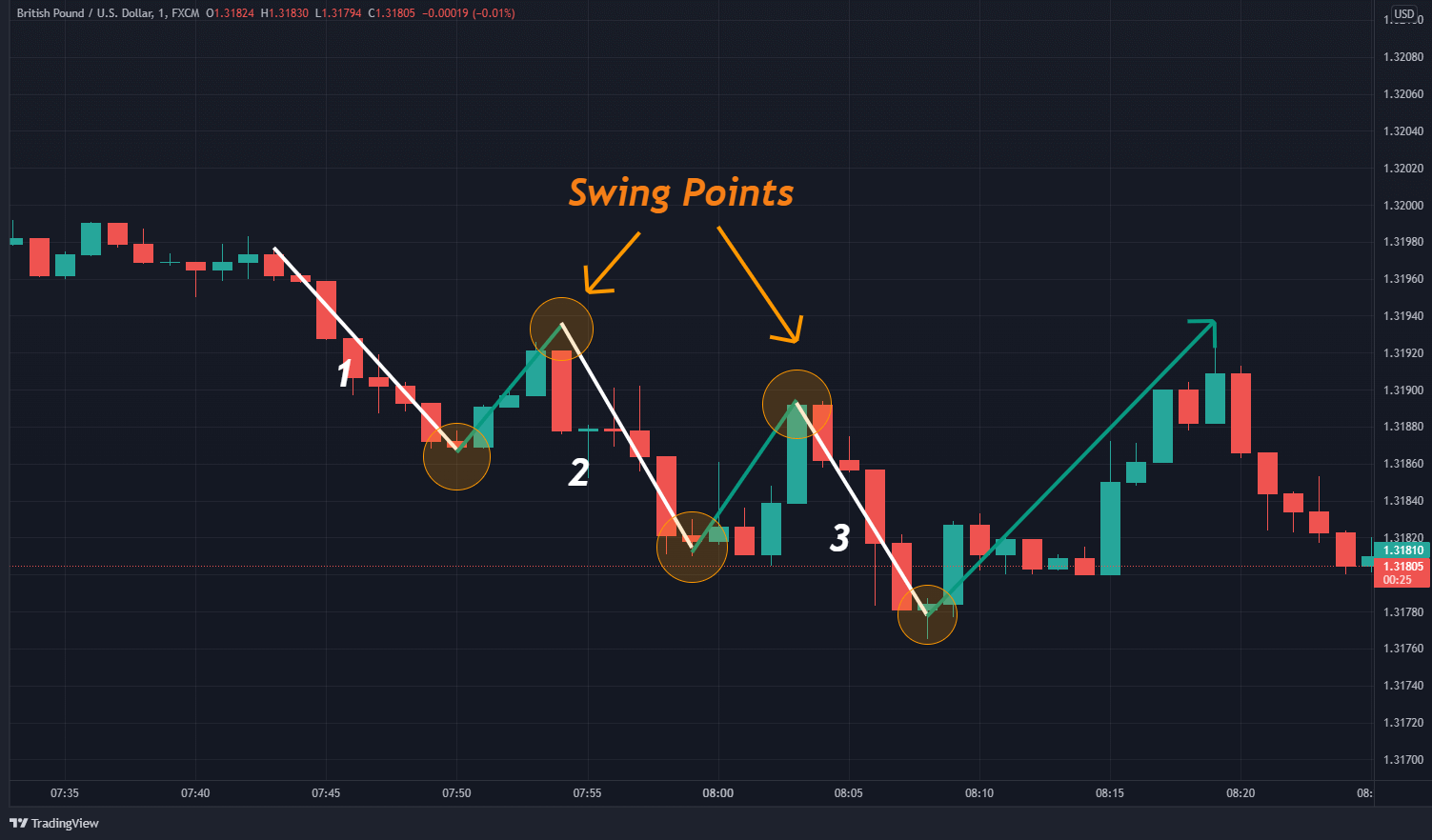

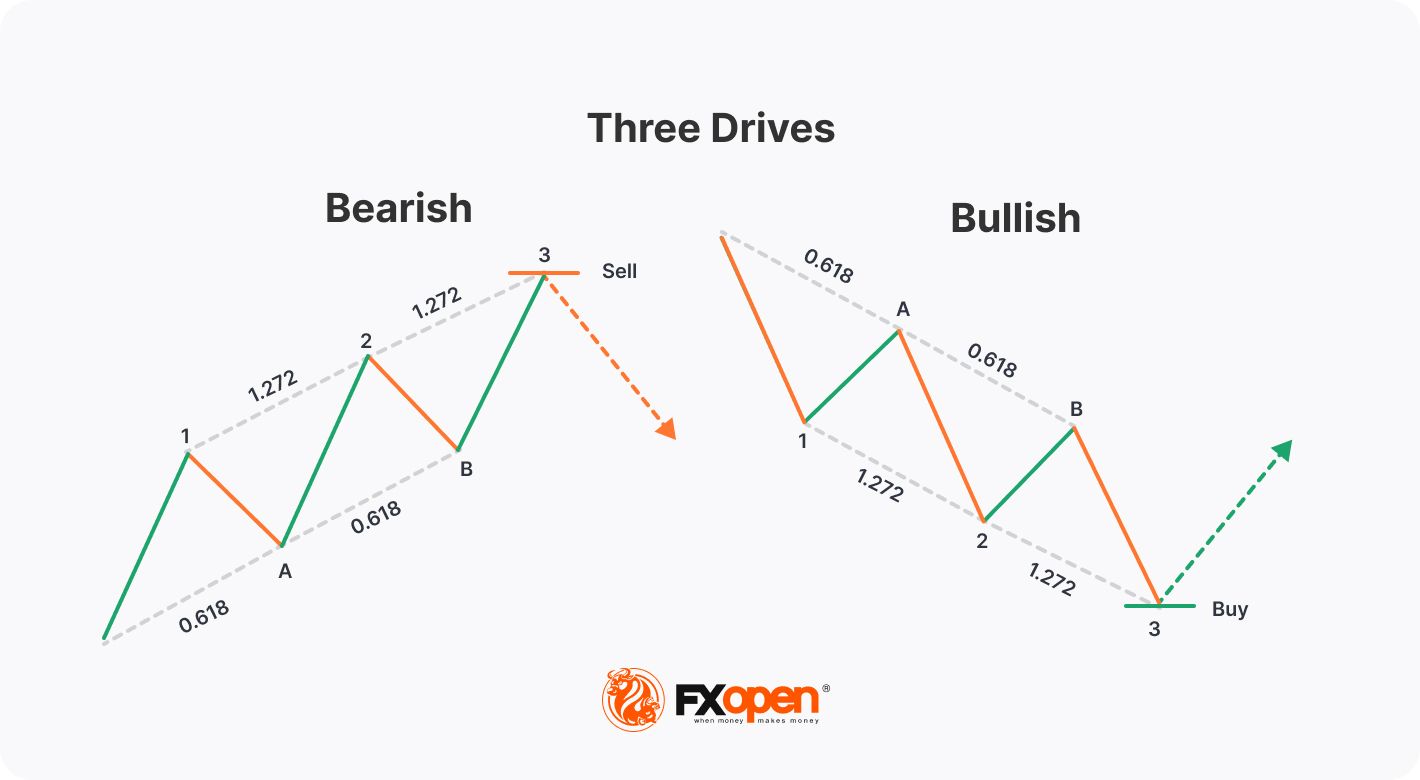

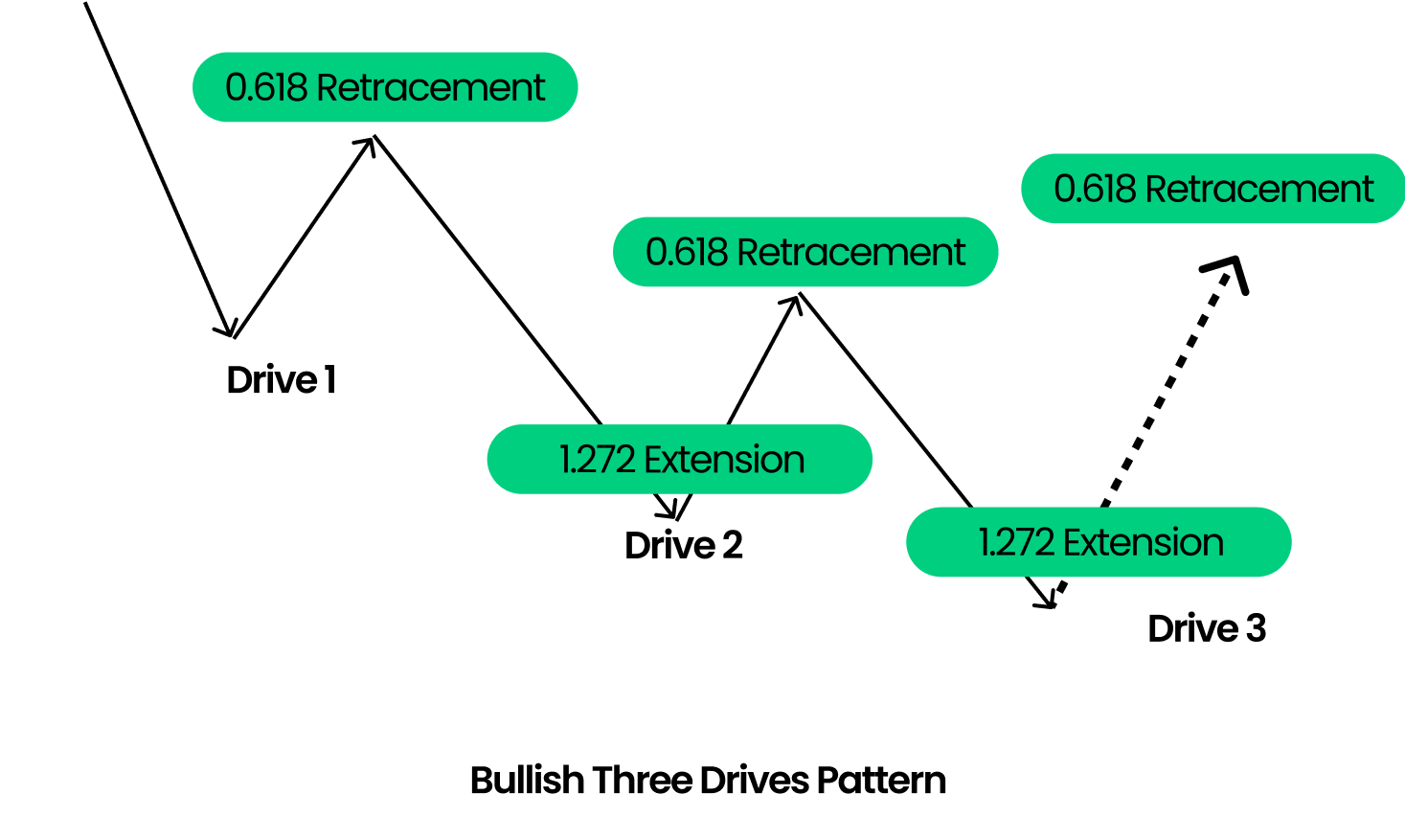

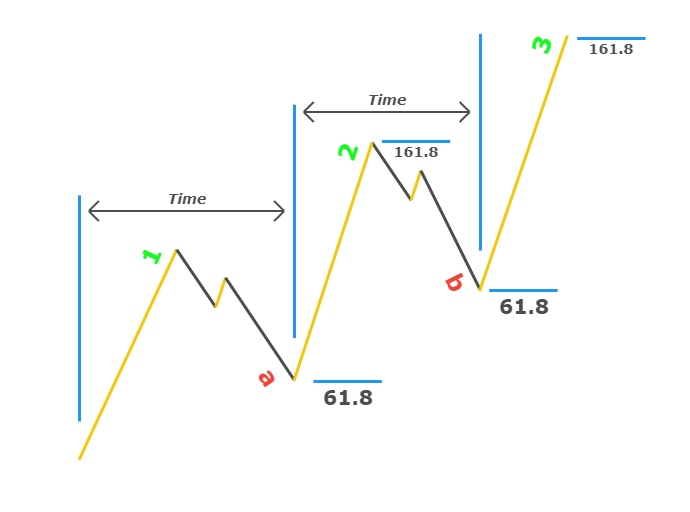

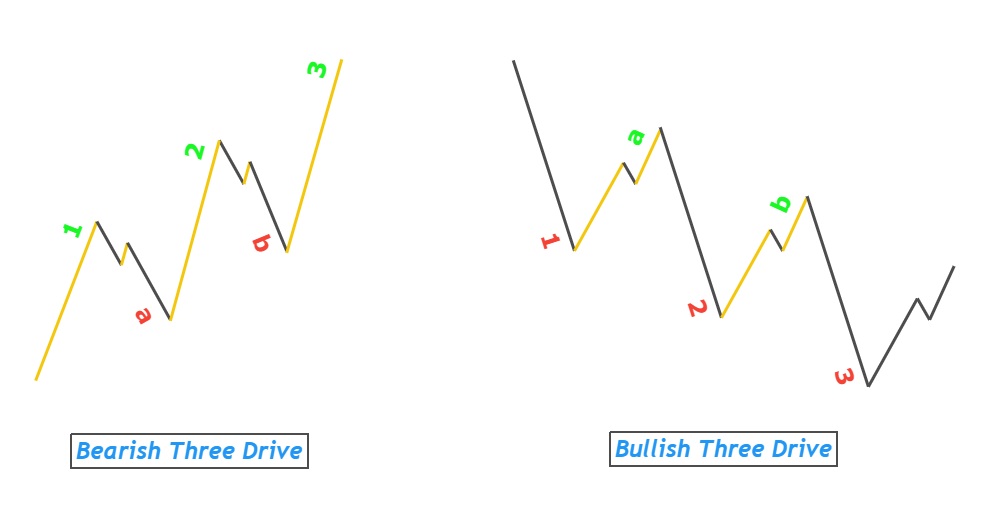

3 Drive Pattern - It is similar to the abcd pattern. Web the three drives is a reversal pattern of the family of harmonic patterns that predicts trend reversal with higher accuracy. Symmetry in both price and time is critical. We will study this price pattern from a few different perspectives. It is important not to force the pattern on the chart. It derives its name from the fact that the price action in it is three consecutive drives to the top (bearish 3 drive) or to the bottom (bullish 3 drive). It consists of three consecutive drives (or legs) in the direction of the new trend, with. This post will show you what you need to know. 3 drive is defined by five points x, a, b, c, and d, of which: Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. Symmetry in both price and time is critical. It is classified as a harmonic reversal pattern and comes in two forms: It is important not to force the pattern on the chart. It is important not to force the pattern on the chart. It can help identify both buying and selling opportunities for the traders in the market. Web the three drives drawing tool allows users to visually identify potential three drives chart patterns. Traders look for three consecutive, symmetrical bullish or bearish legs, known as drives, with the third point marking the completion of the formation. It can signal that the market is exhausted in its current move and a possible. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. Web the three drive chart pattern is a formation of three consecutive symmetrical price movements. For a bearish 3 drive, x, b, d are tops of the price plot, and a and с are bottoms. It is classified as a harmonic reversal pattern and comes in two forms: The three drives pattern is a harmonic reversal pattern. Traders look for. It derives its name from the fact that the price action in it is three consecutive drives to the top (bearish 3 drive) or to the bottom (bullish 3 drive). 3 drive is defined by five points x, a, b, c, and d, of which: Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to. Currency traders use the three drives to identify potential reversal zones in the live forex market. Web the three drives chart pattern is a formation of three consecutive symmetrical price movements. Symmetry in both price and time is critical. The three drives setup or pattern is a rare occurrence because it requires symmetry in terms of both price as well. Currency traders use the three drives to identify potential reversal zones in the live forex market. We will study this price pattern from a few different perspectives. It derives its name from the fact that the price action in it is three consecutive drives to the top (bearish 3 drive) or to the bottom (bullish 3 drive). Web the three. 3 drive is defined by five points x, a, b, c, and d, of which: The three drives pattern is a harmonic reversal pattern. Currency traders use the three drives to identify potential reversal zones in the live forex market. Web the three drives is a reversal pattern of the family of harmonic patterns that predicts trend reversal with higher. Web the three drives pattern is a harmonic formation that helps clue us into the possibility of a market reversal following a prolonged price trend. Symmetry in both price and time is critical. It can help identify both buying and selling opportunities for the traders in the market. Web the three drives pattern, sometimes referred to as the 3 drives. Currency traders use the three drives to identify potential reversal zones in the live forex market. Traders look for three consecutive, symmetrical bullish or bearish legs, known as drives, with the third point marking the completion of the formation. It is important not to force the pattern on the chart. It is classified as a harmonic reversal pattern and comes. It consists of three consecutive drives (or legs) in the direction of the new trend, with. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a. It can help identify both buying and selling opportunities for the traders in the market. Web 3 drive is a fibonacci pattern. If it is not really there, the best decision would be not to trade it. It consists of three consecutive drives (or legs) in the direction of the new trend, with. Web the three drives pattern consists of. Web the three drives pattern is a reversal pattern characterised by a series of higher highs or lower lows that complete at a 127% or 161.8% fibonacci extension. Web the three drives pattern is defined by three distinct, consecutive and symmetrical drives to a top or bottom where each drive completes at 1.13, 1.27 or 1.618. Web 3 drive is. It can signal that the market is exhausted in its current move and a possible. Web the three drives pattern is a reversal pattern characterised by a series of higher highs or lower lows that complete at a 127% or 161.8% fibonacci extension. The three drives pattern is a harmonic reversal pattern. This post will show you what you need to know. The three drives setup or pattern is a rare occurrence because it requires symmetry in terms of both price as well as time. Web the three drive chart pattern is a formation of three consecutive symmetrical price movements. If it is not really there, the best decision would be not to trade it. Web the three drives is a reversal pattern of the family of harmonic patterns that predicts trend reversal with higher accuracy. In its bullish form, the market is making three final drives to a bottom before an uptrend forms. Web the three drives pattern is a harmonic formation that helps clue us into the possibility of a market reversal following a prolonged price trend. We will study this price pattern from a few different perspectives. The difference is that a three drives pattern is made of 5 legs, while an abcd pattern has only 4. It is important not to force the pattern on the chart. 3 drive is defined by five points x, a, b, c, and d, of which: The pattern consists of a series of drives and retracements. It derives its name from the fact that the price action in it is three consecutive drives to the top (bearish 3 drive) or to the bottom (bullish 3 drive).Bullish and Bearish Three Drives Pattern Explained Forex Training Group

Bullish and Bearish Three Drives Pattern Explained Forex Training Group

How To Trade The Three Drives Pattern

Trading With the Three Drives Pattern Market Pulse

Advanced Trading The Bullish Three Drive Pattern Blueberry Markets

Three Drives Pattern Explained 3 Drive Strategy ForexBee

3 Drives Pattern 3 Drives Harmonic Pattern Trading Strategy 3 Drive

Harmonic Patterns Cheat Sheet Download FREE PDF ForexBee

Advanced Trading The Bullish Three Drive Pattern Blueberry Markets

Better Know An Indicator Three Drives Pattern YouTube

In Its Bullish Form, The Market Is Making Three Final Drives To A Bottom Before An Uptrend Forms.

Analysts Connect A Series Of Higher Highs And Lower Lows, Occurring Between 127 And 161.8 Percent Of.

It Can Help Identify Both Buying And Selling Opportunities For The Traders In The Market.

It Is Important Not To Force The Pattern On The Chart.

Related Post: