3 Line Strike Pattern

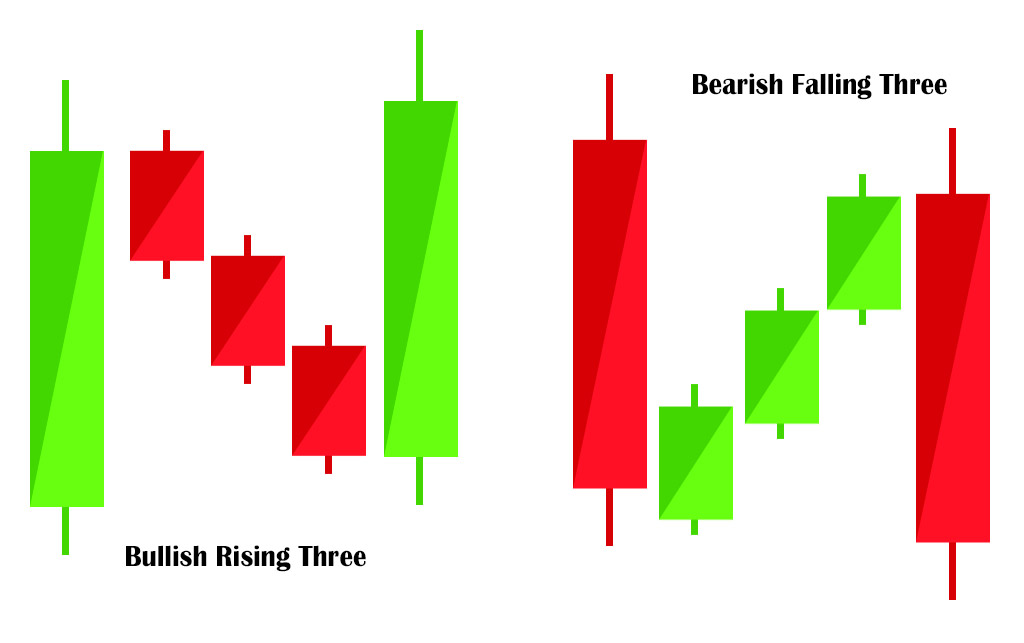

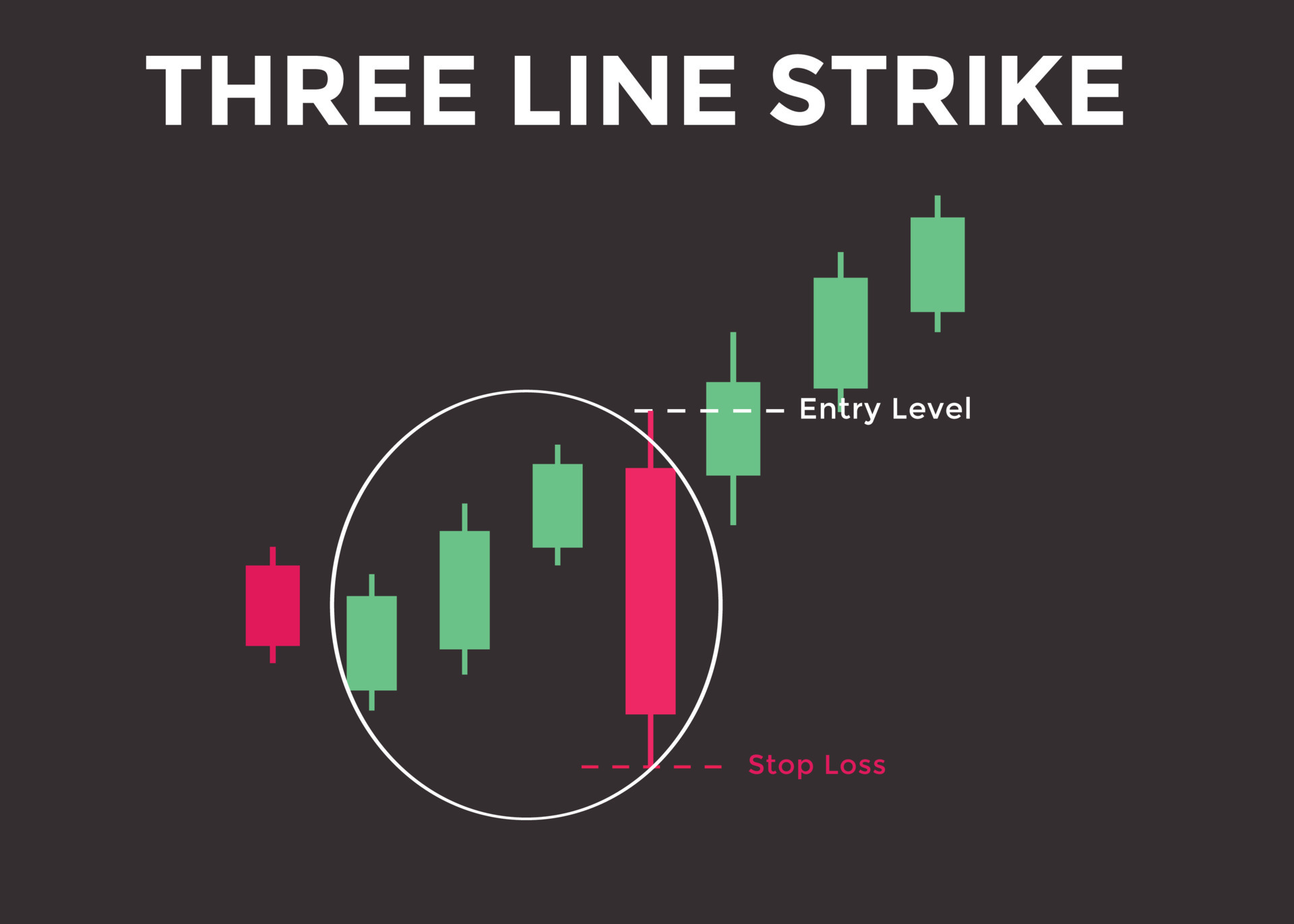

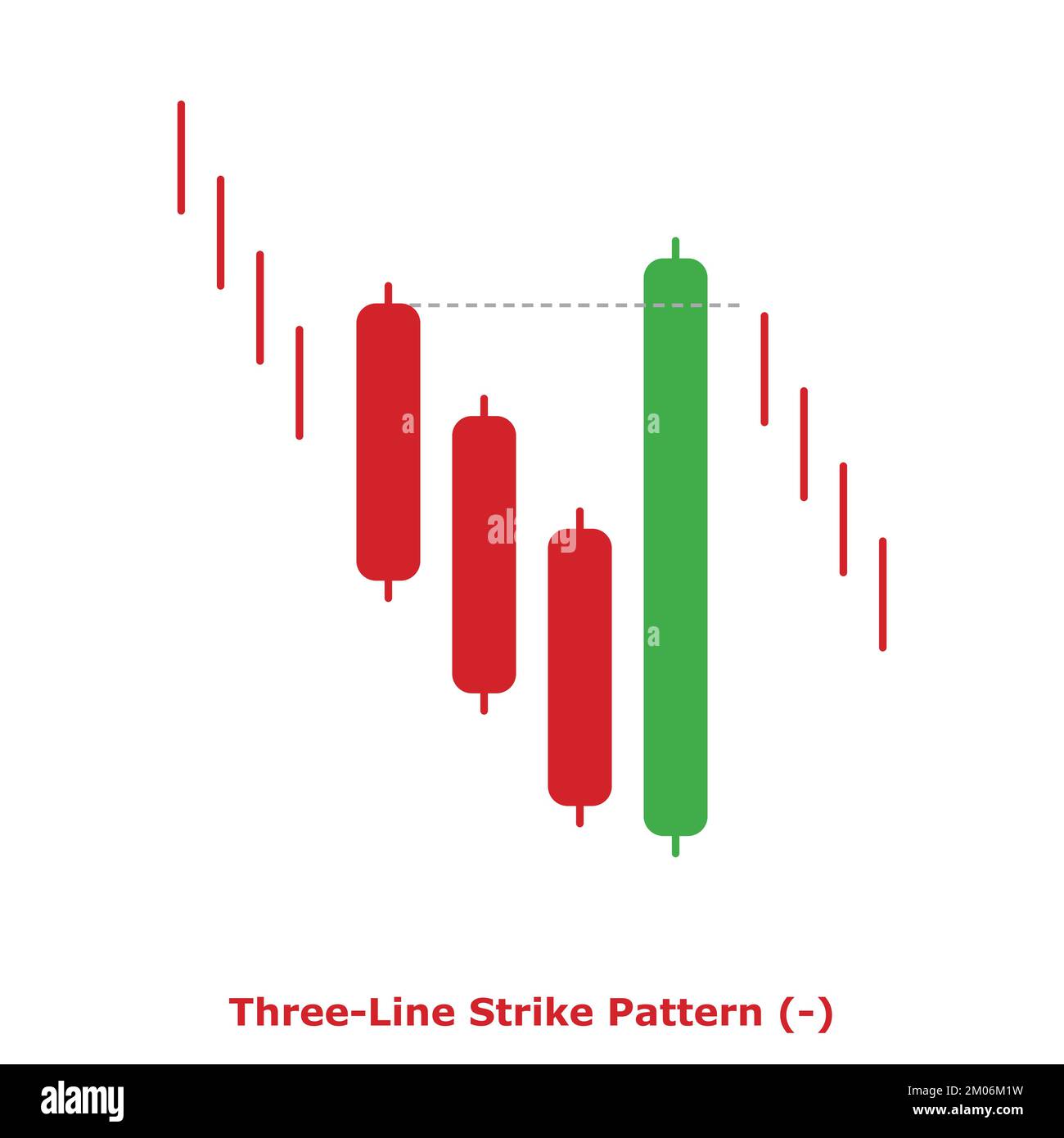

3 Line Strike Pattern - Web michael harrigan, a retired f.b.i. Depending on their heights and collocation, a bullish or a bearish trend continuation can. It forms in a bullish trend and is believed to signal the continuation of the bullish. As mentioned, the pattern can be. The three line strike is a candlestick pattern used in technical analysis to trade trend continuations. Web the three line strike candlestick pattern is a bullish reversal indicator that appears in a downtrend. Web the three line strike pattern is a powerful tool in a trader’s arsenal, offering valuable insights into market trends and potential price reversals. Web the three line strike candlestick pattern consists of four candlesticks and can be found during both upward or downward trend. Web what is the three line strike pattern? The three line strike candlestick pattern is a significant tool in technical analysis, known for indicating potential trend reversals. Web one of the most powerful and easy to recognize continuation patterns for beginners is the three line strike candlestick pattern. Depending on their heights and collocation, a bullish or a bearish trend continuation can. First of all, it is important to know that the “three line strike” candlestick pattern is known as a reversal pattern. Web three line strike candlestick pattern | bullish candlestick patternscan you recognize the three line strike candlestick pattern? They start with three bearish candlesticks, and then the fourth bullish. Web bullish three line strike is a four candle bullish continuation candlestick pattern. It is made up of three bullish candlesticks, each with a higher close than the. The three line strike is a candlestick pattern used in technical analysis to trade trend continuations. Web what is the three line strike pattern? The three line strike candlestick pattern is a significant tool in technical analysis, known for indicating potential trend reversals. The three line strike is a candlestick pattern used in technical analysis to trade trend continuations. Web what is a bearish three line strike in candlestick patterns? The pattern consists of four. It consists of four candles: It is made up of three bullish candlesticks, each with a higher close than the. As mentioned, the pattern can be. First of all, it is important to know that the “three line strike” candlestick pattern is known as a reversal pattern. Web three line strike is a trend continuation candlestick pattern consisting of four candles. The pattern consists of four. Web the three line strike pattern is a powerful tool in a trader’s arsenal,. It consists of three consecutive candles of the same color,. Web what is the three line strike pattern? Web the bullish three line strike is a trend continuation pattern that occurs in an uptrend. Web the bullish three line strike pattern is composed of four candles where the first three are rising and the last one is a big bearish. Web three line strike pattern: Special agent, said the image captured by doug mills, a new york times photographer, seems to show a bullet streaking past. It consists of four candles: The few samples found, 69, may be the reason why the pattern. Web the three line strike candlestick pattern consists of four candlesticks and can be found during both. As mentioned, the pattern can be. Web three line strike candlestick pattern | bullish candlestick patternscan you recognize the three line strike candlestick pattern? The pattern consists of four. Web the three line strike candlestick pattern consists of four candlesticks and can be found during both upward or downward trend. Watch our video to learn the. While candlestick patterns apply in all timeframes, the three line strike. As mentioned, the pattern can be. Watch our video to learn the. It consists of four candles: Web a three line strike pattern consists of four candlesticks that form near support levels. Written by internationally known author and trader. The few samples found, 69, may be the reason why the pattern. The pattern consists of four. Web a three line strike pattern consists of four candlesticks that form near support levels. It forms in a bullish trend and is believed to signal the continuation of the bullish. It consists of three consecutive candles of the same color,. Watch our video to learn the. The few samples found, 69, may be the reason why the pattern. Web a three line strike pattern consists of four candlesticks that form near support levels. The three line strike is a candlestick pattern used in technical analysis to trade trend continuations. Web the 3 line strike, also sometimes called the three line strike continuation pattern, is a candlestick charting pattern used by traders to identify potential. Web michael harrigan, a retired f.b.i. Web one of the most powerful and easy to recognize continuation patterns for beginners is the three line strike candlestick pattern. Web the 3 line strike pattern is a. Web the three line strike candlestick pattern is a bullish reversal indicator that appears in a downtrend. Web a three line strike pattern consists of four candlesticks that form near support levels. Web one of the most powerful and easy to recognize continuation patterns for beginners is the three line strike candlestick pattern. It is made up of three bullish. It is made up of three bullish candlesticks, each with a higher close than the. While candlestick patterns apply in all timeframes, the three line strike. Watch our video to learn the. It consists of four candles: It consists of three consecutive candles of the same color,. Web what is the three line strike pattern? Web bullish three line strike is a four candle bullish continuation candlestick pattern. Web a three line strike pattern consists of four candlesticks that form near support levels. Web the bullish three line strike pattern is composed of four candles where the first three are rising and the last one is a big bearish candle that englobes the. Web the three line strike candlestick pattern consists of four candlesticks and can be found during both upward or downward trend. First of all, it is important to know that the “three line strike” candlestick pattern is known as a reversal pattern. Web the three line strike candlestick pattern is a bullish reversal indicator that appears in a downtrend. The three line strike is a candlestick pattern used in technical analysis to trade trend continuations. Web the three line strike pattern is a powerful tool in a trader’s arsenal, offering valuable insights into market trends and potential price reversals. Web three line strike candlestick pattern | bullish candlestick patternscan you recognize the three line strike candlestick pattern? Web the bullish three line strike is a trend continuation pattern that occurs in an uptrend.What Is a Candlestick Pattern?

ThreeLine Strike candlestick Pattern PDF Guide Trading PDF

Engulfing Candles Price Action Arrows and Scanner Dashboard Trading

Three Line Strike candlestick chart pattern. Candlestick chart Pattern

ThreeLine Strike Pattern Bearish Green & Red Round Bearish

Three Line Strike candlestick chart pattern. Candlestick chart Pattern

Bullish ThreeLine Strike Candlestick Pattern The Forex Geek

ThreeLine Strike Pattern Complete Guide [2022] PatternsWizard

Bearish Three Line Strike Candlestick Pattern Explained (Trading

Three Line Strike Candlestick Pattern Price Action Tutorial Tani Forex

It Forms In A Bullish Trend And Is Believed To Signal The Continuation Of The Bullish.

Web Dive Into The Three Line Strike Pattern, Its Types, And How To Use It With Thomas Bulkowski's Approach.

Web The 3 Line Strike, Also Sometimes Called The Three Line Strike Continuation Pattern, Is A Candlestick Charting Pattern Used By Traders To Identify Potential.

The Pattern Consists Of Four.

Related Post:

:max_bytes(150000):strip_icc()/The5MostPowerfulCandlestickPatterns1-30019e515b6a4ed485b04ab2cfe26157.png)

![ThreeLine Strike Pattern Complete Guide [2022] PatternsWizard](https://patternswizard.com/wp-content/uploads/patterns-illustrations/3linestrike-confirmed-bullish-rr2-targetreached-retested-cryptocurrency-ethbtc-1h-20171223T210000.png)