Bull Engulfing Pattern

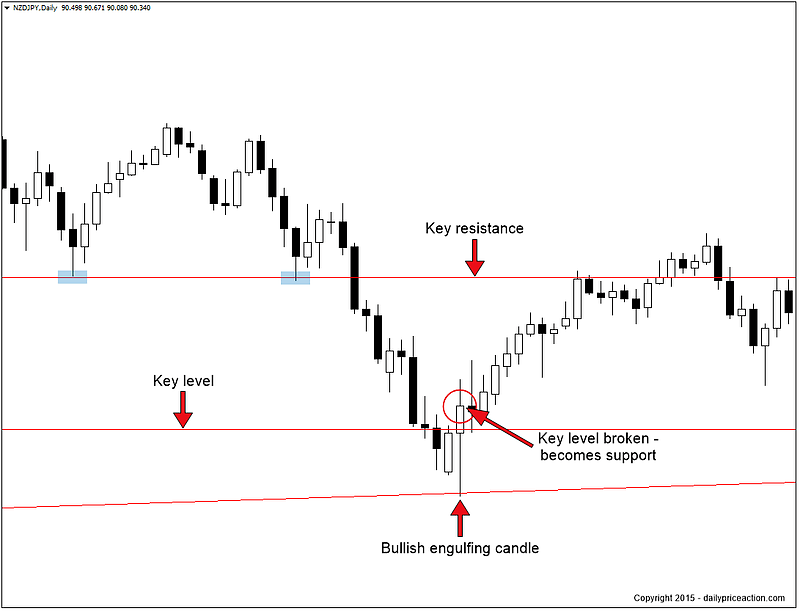

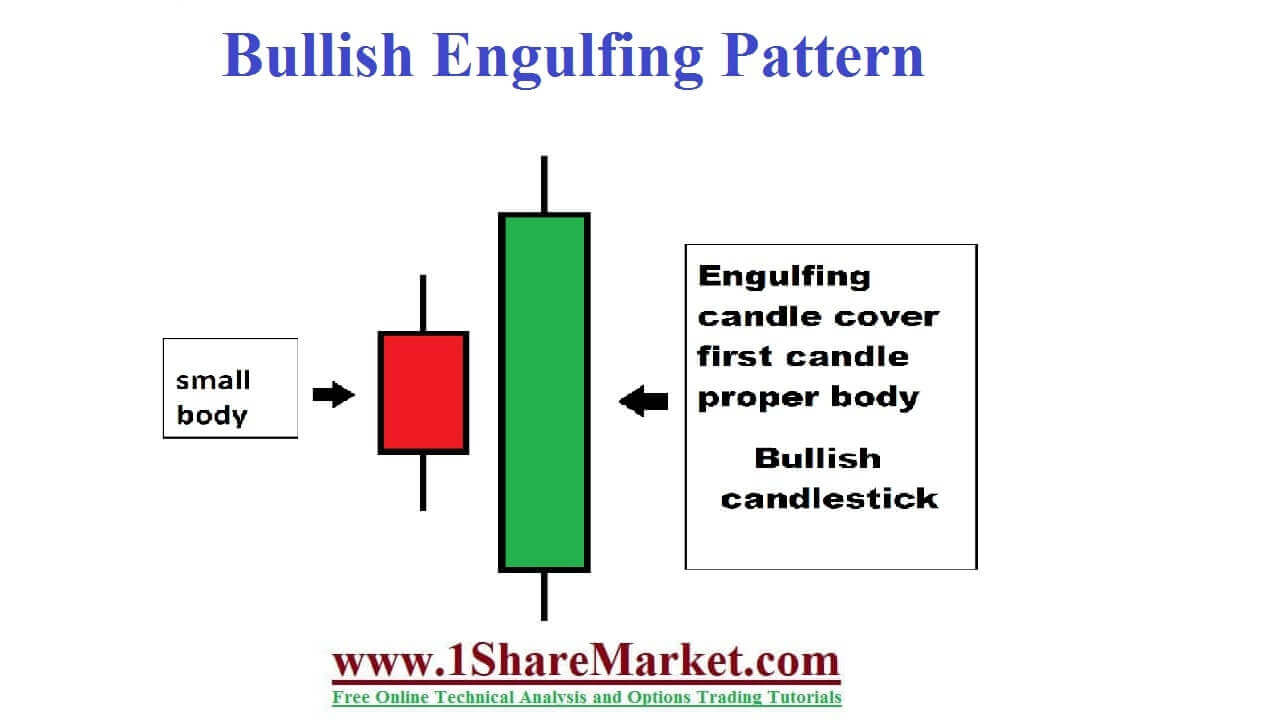

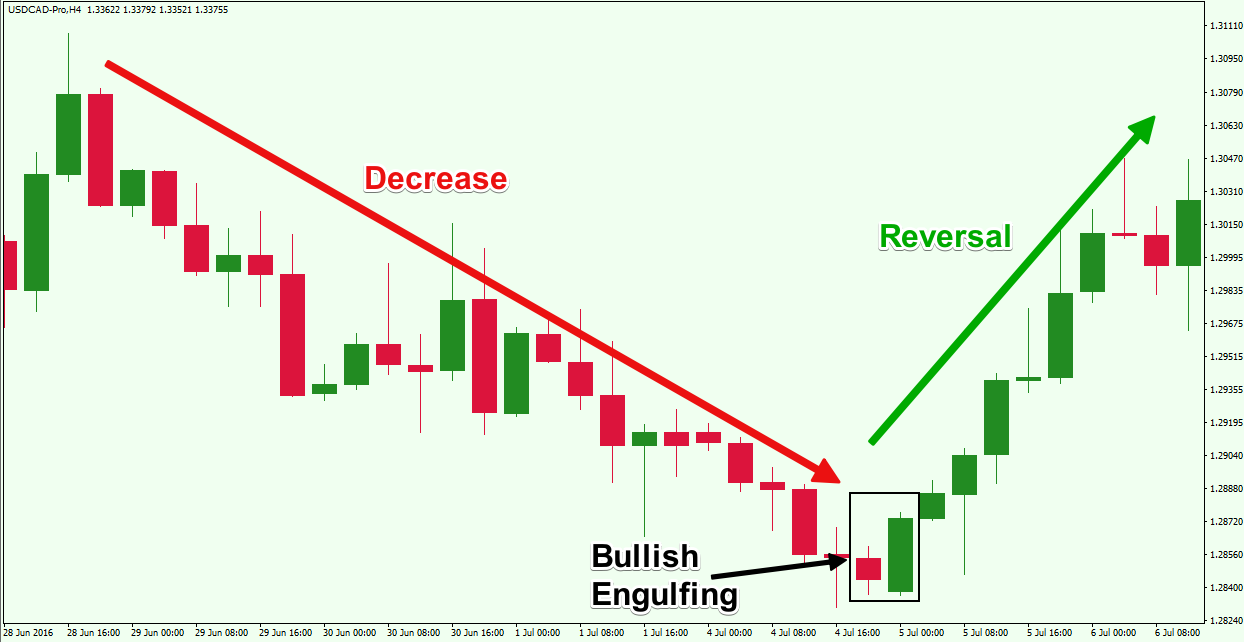

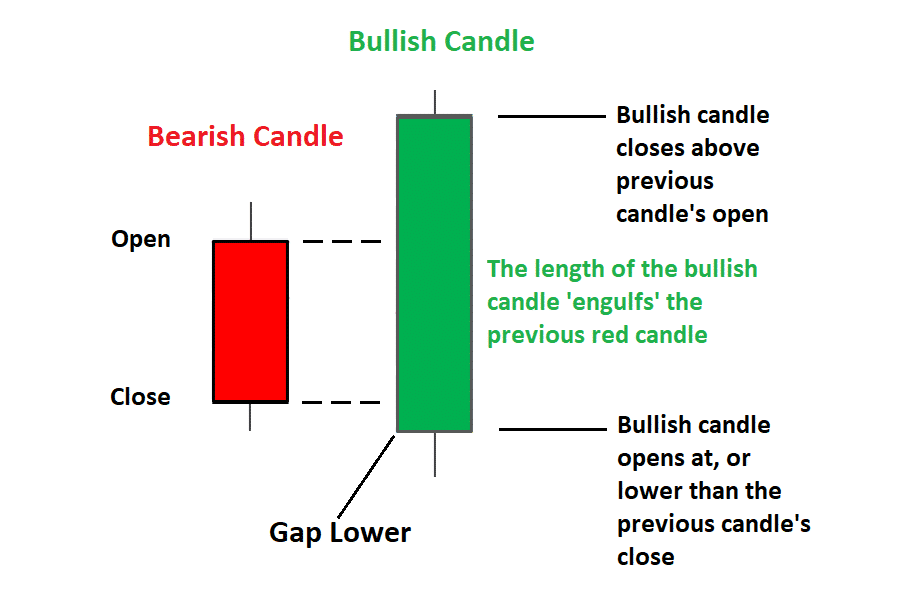

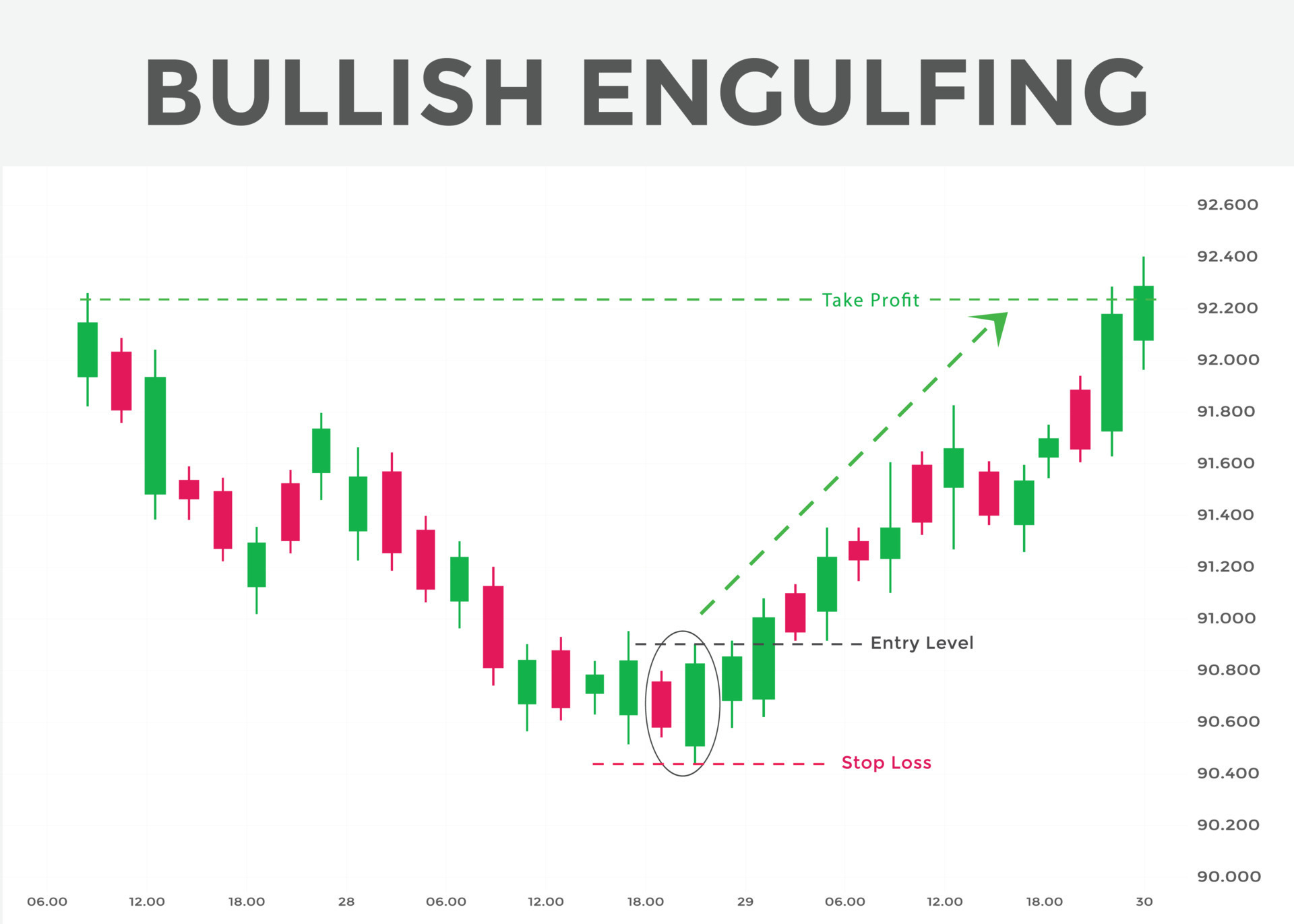

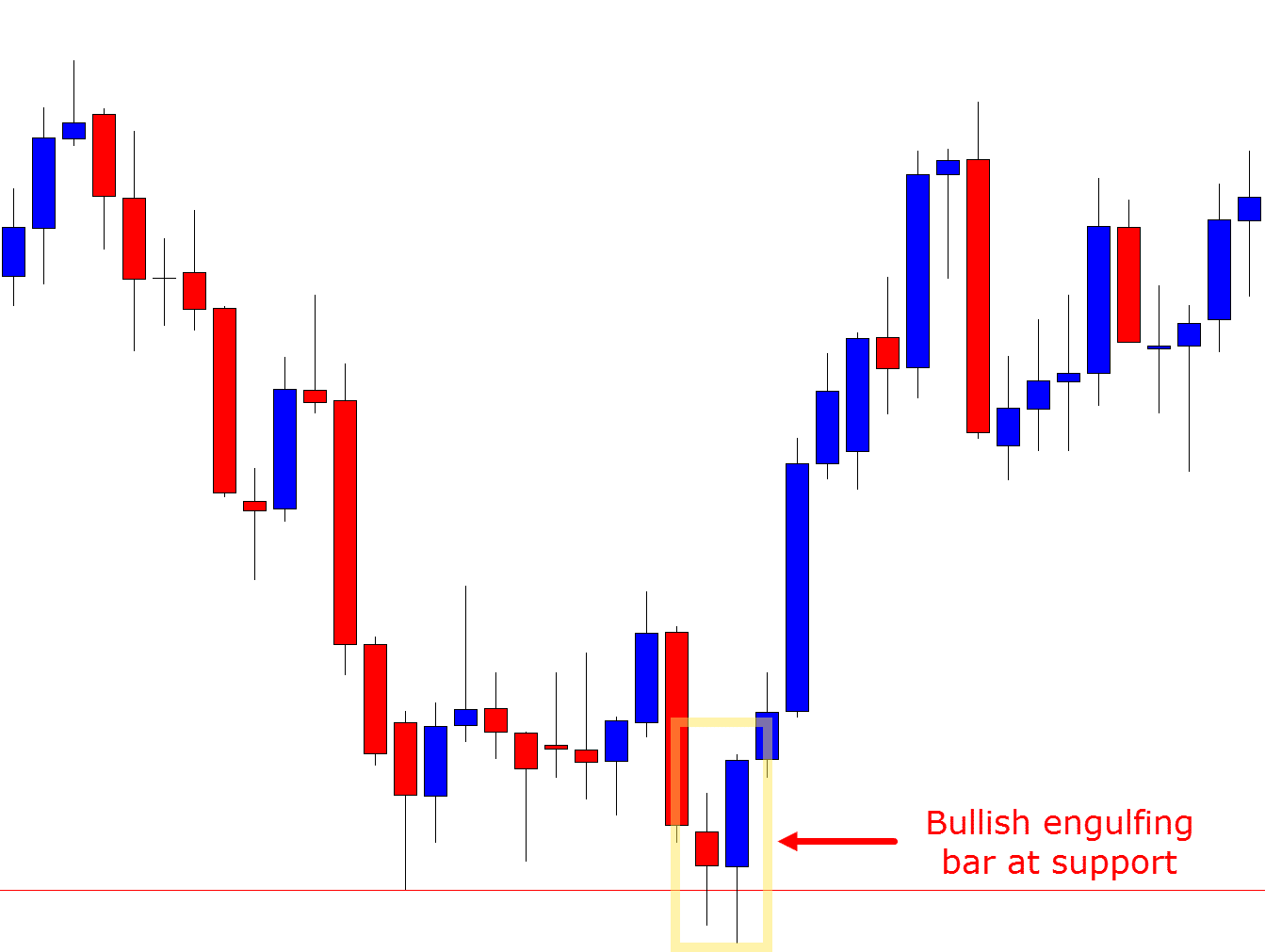

Bull Engulfing Pattern - Web the bullish engulfing pattern is a strong candlestick pattern that gives traders a practical tool for identifying future gains. Web the bullish engulfing candlestick pattern is a bullish reversal pattern, usually occurring at the bottom of a downtrend. As long as the index remains above this level, the trend may remain positive. Web a bullish engulfing pattern is a type of price chart pattern that indicates a bullish reversal in a security’s price performance. While initially, the market is moving up, affirming bulls in control, the second candle implies a different thing. Typically, when the second smaller candle engulfs the first, the price fails and causes a bearish reversal. Web the bullish engulfing candle appears at the bottom of a downtrend and indicates a surge in buying pressure. Web bullish engulfing pattern. The bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow. Web definition of the bullish engulfing candlestick pattern. A bullish candle engulfs the body of the previous bearish candle: Here’s the idea behind it… The bullish engulfing pattern often triggers a reversal in trend as more buyers enter. While initially, the market is moving up, affirming bulls in control, the second candle implies a different thing. Web bullish engulfing pattern. This pattern implies that buyers have complete control in the market overpowering the sellers. Web a bullish engulfing pattern is a candlestick pattern that suggests a potential market reversal from a bearish to a bullish trend. Typically, when the 2nd smaller candle engulfs the first, the. Web how to use the bullish engulfing pattern to catch market bottoms with precision. As the name suggests, this is a bullish pattern which prompts the trader to go long. Web bullish engulfing pattern. If properly examined and verified, this pattern can offer excellent opportunities to participate in market dynamics. This pattern implies that buyers have complete control in the market overpowering the sellers. Web specifically, a bullish engulfing pattern has formed, a strong indicator of potential upward movement. As the name suggests, this is a bullish pattern which prompts. Web understanding the bullish engulfing pattern means diving into the details of price action, recognizing support and resistance levels, and knowing how to trade it. The bullish engulfing pattern often triggers a reversal in trend as more buyers enter. Web the bullish engulfing pattern is one of my favorite reversal patterns in the forex market. The pattern consists of a. They are popular candlestick patterns because they are easy to spot and trade. Comprising two consecutive candles, the pattern features a smaller. Currently, the mog price trades at $0.0000021 and an intraday pullback of 3.15%. Web a bullish engulfing pattern is a candlestick pattern that suggests a potential market reversal from a bearish to a bullish trend. Web bullish engulfing. Web the bullish engulfing candle appears at the bottom of a downtrend and indicates a surge in buying pressure. Typically, when the second smaller candle engulfs the first, the price fails and causes a bearish reversal. Web the bearish engulfing pattern implies an unexpected change of sentiment in the market. Currently, the mog price trades at $0.0000021 and an intraday. Web a bearish engulfing pattern consists of two candlesticks that form near resistance levels where the second bearish candle engulfs the smaller first bullish candle. As similar as they may be, i believe each deserves its own spotlight given the significance of the pattern. It gets its name from the second candle that engulfs the first candle in the bullish. Web a bullish engulfing pattern is a type of price chart pattern that indicates a bullish reversal in a security’s price performance. Web the bullish engulfing pattern provides the strongest signal when appearing at the bottom of a downtrend and indicates a surge in buying pressure. It is a popular technical analysis indicator used by traders to anticipate bullish uptrend. Typically, when the 2nd smaller candle engulfs the first, the. As the name suggests, this is a bullish pattern which prompts the trader to go long. Web a bullish engulfing pattern is a candlestick pattern that suggests a potential market reversal from a bearish to a bullish trend. Besides using the bullish engulfing pattern as an entry trigger, it can. Typically, when the second smaller candle engulfs the first, the price fails and causes a bearish reversal. It gets its name from the second candle that engulfs the first candle in the bullish direction. Web a bearish engulfing pattern consists of two candlesticks that form near resistance levels where the second bearish candle engulfs the smaller first bullish candle. Web. Here’s the idea behind it… Currently, the mog price trades at $0.0000021 and an intraday pullback of 3.15%. The bullish engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow. With a bullish trend in the macd, signal lines, and 50d ema, the meme coin approaches the 2.618% fib level. Web. Web bullish engulfing pattern. Typically, when the 2nd smaller candle engulfs the first, the. Web a bullish engulfing pattern consists of two candlesticks that form near support levels; Web the bullish engulfing pattern is one of my favorite reversal patterns in the forex market. Web a bullish engulfing pattern is a candlestick pattern that forms when a small black candlestick. They are popular candlestick patterns because they are easy to spot and trade. Web a bullish engulfing pattern is a type of price chart pattern that indicates a bullish reversal in a security’s price performance. How to identify a bullish engulfing pattern? Web a bearish engulfing pattern consists of two candlesticks that form near resistance levels where the second bearish candle engulfs the smaller first bullish candle. Typically, when the 2nd smaller candle engulfs the first, the. With a bullish trend in the macd, signal lines, and 50d ema, the meme coin approaches the 2.618% fib level. As the name suggests, this is a bullish pattern which prompts the trader to go long. Web the bullish engulfing candlestick pattern is a bullish reversal pattern, usually occurring at the bottom of a downtrend. As similar as they may be, i believe each deserves its own spotlight given the significance of the pattern. I have previously written about how to trade the bearish engulfing pattern, and as you might expect there are many similarities between the two. The first candle in the pattern is bearish, followed by a bullish candle that completely engulfs the body of the first candle. Web the bullish engulfing pattern is a two candlestick pattern which appears at the bottom of the downtrend. Web understanding the bullish engulfing pattern means diving into the details of price action, recognizing support and resistance levels, and knowing how to trade it. This technical pattern is considered bullish, suggesting that the stock may experience a. The pattern consists of a smaller bearish candle followed by a larger bullish candle that 'engulfs' the previous candle. Comprising two consecutive candles, the pattern features a smaller.Bullish engulfing pattern bullish engulfing candlestick pattern

bullishengulfingreversalpattern Forex Training Group

Bullish Engulfing Pattern An Important Technical Pattern

best candlestick patterns for forex, stock, cryptocurrency trades

What are Bullish Candlestick Patterns?

Bullish Engulfing Pattern What is it? How to use it?

Bullish Engulfing Pattern Definition, Example, and What It Means

Bullish Engulfing Pattern The Ultimate Guide Daily Price Action

Trading the Bullish Engulfing Candle

Bullish and Bearish Engulfing Candlesticks ThinkMarkets UK

If Properly Examined And Verified, This Pattern Can Offer Excellent Opportunities To Participate In Market Dynamics.

Besides Using The Bullish Engulfing Pattern As An Entry Trigger, It Can Also Alert You To Potential Trend Reversal Trading Opportunities For An Engulfing Trading Strategy.

Web Specifically, A Bullish Engulfing Pattern Has Formed, A Strong Indicator Of Potential Upward Movement.

Web A Bullish Engulfing Pattern Is A Candlestick Pattern That Forms When A Small Black Candlestick Is Followed The Next Day By A Large White Candlestick, The Body Of Which Completely Overlaps Or.

Related Post:

:max_bytes(150000):strip_icc()/BullishEngulfingPatternDefinition2-5f046aee5fe24520bfd4e6ad8abaeb74.png)