Candle Pattern Morning Star

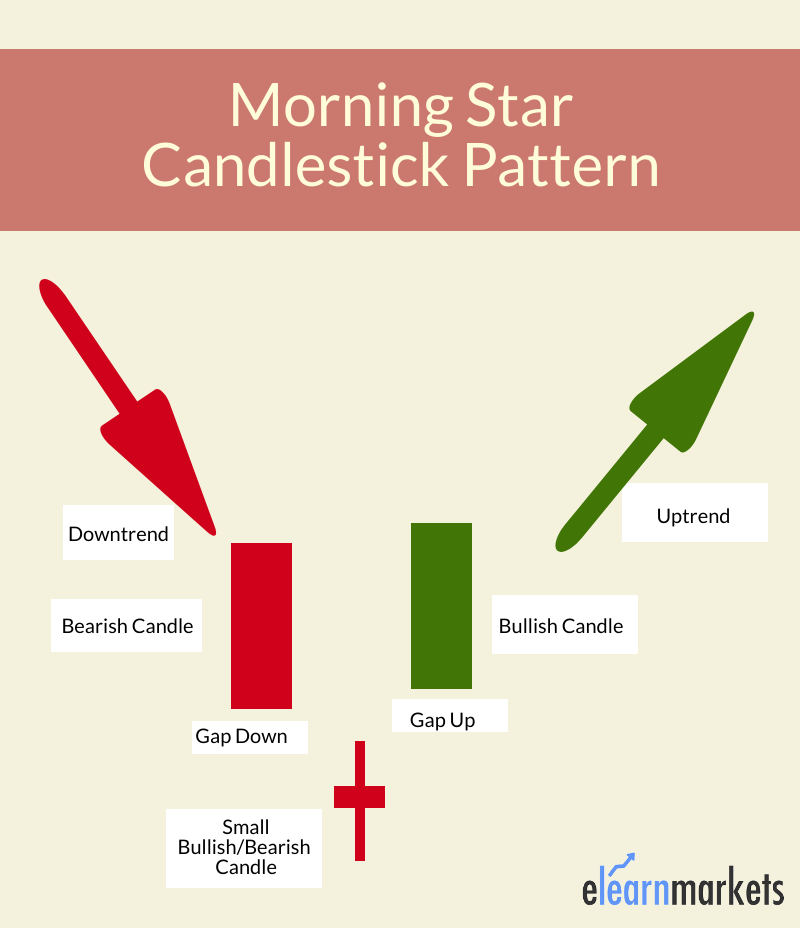

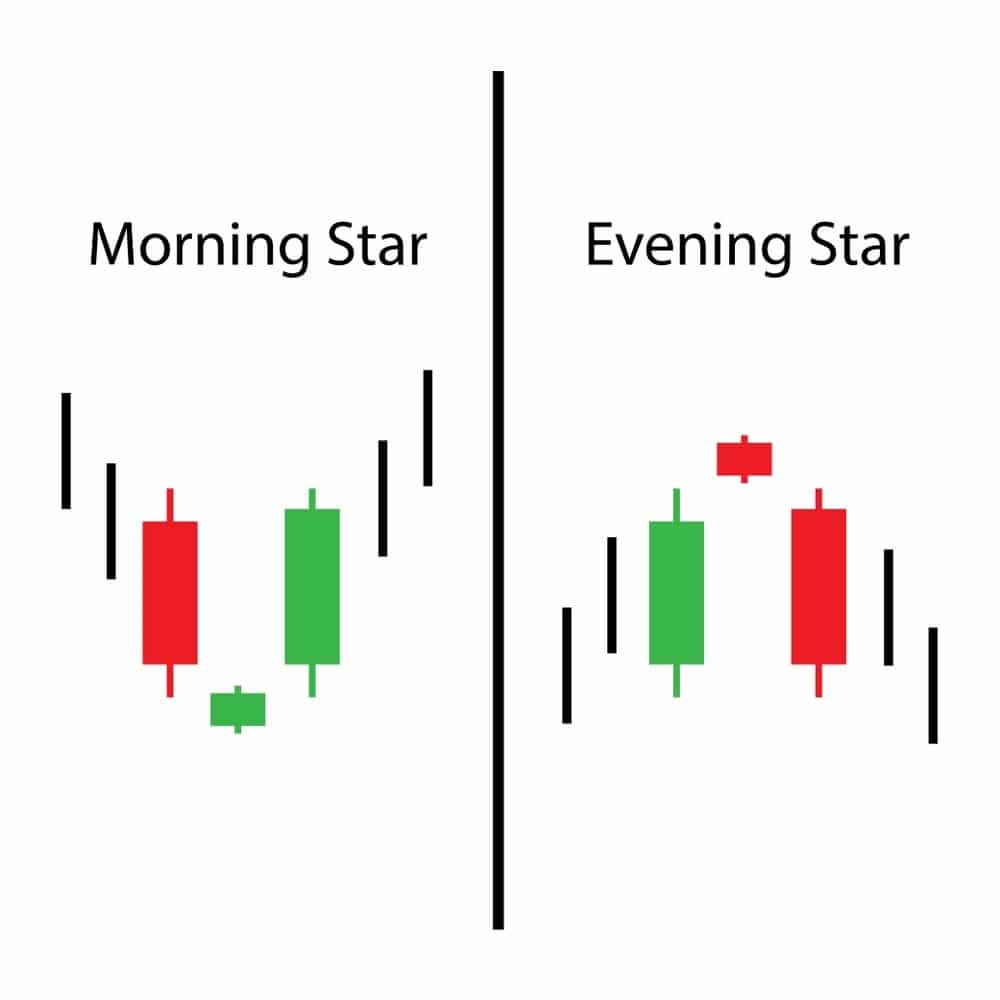

Candle Pattern Morning Star - Usually, it appears after a price decline and shows rejection from lower prices. How to trade the morning star pattern; It typically forms after a downward trend, telling us it is the start of an upward climb and indicating a reversal in the previous price trend. The first line is any black candle appearing as a long line in an uptrend: Can anyone reccomend something to do for about 4 hours in a morning. Web answer 1 of 2: Web this pine script is designed to identify and indicate the morning star candlestick pattern on financial charts. Web a morning star is a bullish visual pattern in technical analysis with three candlesticks. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. Web the morning star is a reversal candlestick pattern that signals a potential trend change from downside to upside movement. Oil and gas giant conocophillips ( cop) appears to be forming a morning star pattern. How reliable is the morning star in forex trading? Web a morning star is a bullish visual pattern in technical analysis with three candlesticks. Usually, it appears after a price decline and shows rejection from lower prices. The morning star pattern is a bullish reversal indicator that appears at the end of a downtrend, signaling a potential shift to an uptrend. The first line is any black candle appearing as a long line in an uptrend: All organizations except 501(c)(3) organization: It is considered a reversal pattern that calls for a price increase following a sustained downward trend. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web consisting of three candlesticks, morning star candlestick patterns generate bullish trading signals that can be used when establishing long positions in financial markets. Hi my wife and i are spending 1 night in orlando before going to the gulf coast. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up,. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. It’s a bullish reversal pattern. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. A completed morning star formation indicates a new bullish sentiment in the market. The. Web order of the eastern star of florida: Experience the music of renowned classical composers in an intimate and breathtaking setting. Web a morning star is a bullish visual pattern in technical analysis with three candlesticks. Web by josh enomoto, investorplace contributor jul 9, 2024, 8:11 am edt. Long black candle, black candle, black marubozu, opening black marubozu, closing black. Shop online and bring your favorite scent home! Oil and gas giant conocophillips ( cop) appears to be forming a morning star pattern. It’s a bullish reversal pattern. Web order of the eastern star of florida: It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. Web a morning star pattern consists of three candlesticks that form near support levels. All organizations except 501(c)(3) organization: The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick.. The 1st candle is bearish, the 2nd is a spinning top or doji , and the 3rd is a bullish candlestick. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. Web what is a morning star candlestick? It typically forms after a downward trend, telling. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web the morning star is a japanese candlestick pattern. Web answer 1 of 2: The pattern is bullish because we. Typically, the 3rd candle forms a bullish reversal pattern. The pattern is bullish because we expect to have a bull move after a. Usually, it appears after a price decline and shows rejection from lower prices. Web a morning star candle is a bullish reversal pattern in technical analysis that signals a potential trend reversal of a downtrend. A completed. Usually, it appears after a price decline and shows rejection from lower prices. The first line is any black candle appearing as a long line in an uptrend: The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. Web. Web the morning star is a reversal candlestick pattern that signals a potential trend change from downside to upside movement. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. The first line is any black candle appearing as a long line in an uptrend: It is considered a reversal pattern that calls for a price increase following a sustained downward trend. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. The pattern is bullish because we expect to have a bull move after a. Web morning star candlestick is a triple candlestick pattern that indicated bullish reversal. Experience the music of renowned classical composers in an intimate and breathtaking setting. Usually, it appears after a price decline and shows rejection from lower prices. Web a morning star is a bullish visual pattern in technical analysis with three candlesticks. We are a couple in our late 40s. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. Typically, the 3rd candle forms a bullish reversal pattern. Hi my wife and i are spending 1 night in orlando before going to the gulf coast. Web what is a morning star candlestick? Web by josh enomoto, investorplace contributor jul 9, 2024, 8:11 am edt.What Is Morning Star Candlestick? Formation & Uses ELM

Understanding The Morning Star Candlestick Pattern InvestoPower

How To Trade Blog What Is Morning Star Candlestick Pattern? How To Use

Best candlestick patterns morning star candlestick pattern

145 CANDLESTICK PATTERNS PAGE 9 (17) Morning Star ( Bullish

A Guide To Trading With Morning Star Candle Sticks Pattern For Maximum

Morning Star Candlestick Pattern

How To Trade Blog What Is Morning Star Candlestick Pattern? How To Use

Morning Star Candlestick Pattern How to Identify Perfect Morning Star

How To Identify A Morning Star On Forex Charts;

Web Answer 1 Of 2:

Can Anyone Reccomend Something To Do For About 4 Hours In A Morning.

A Completed Morning Star Formation Indicates A New Bullish Sentiment In The Market.

Related Post: