Crypto Chart Patterns

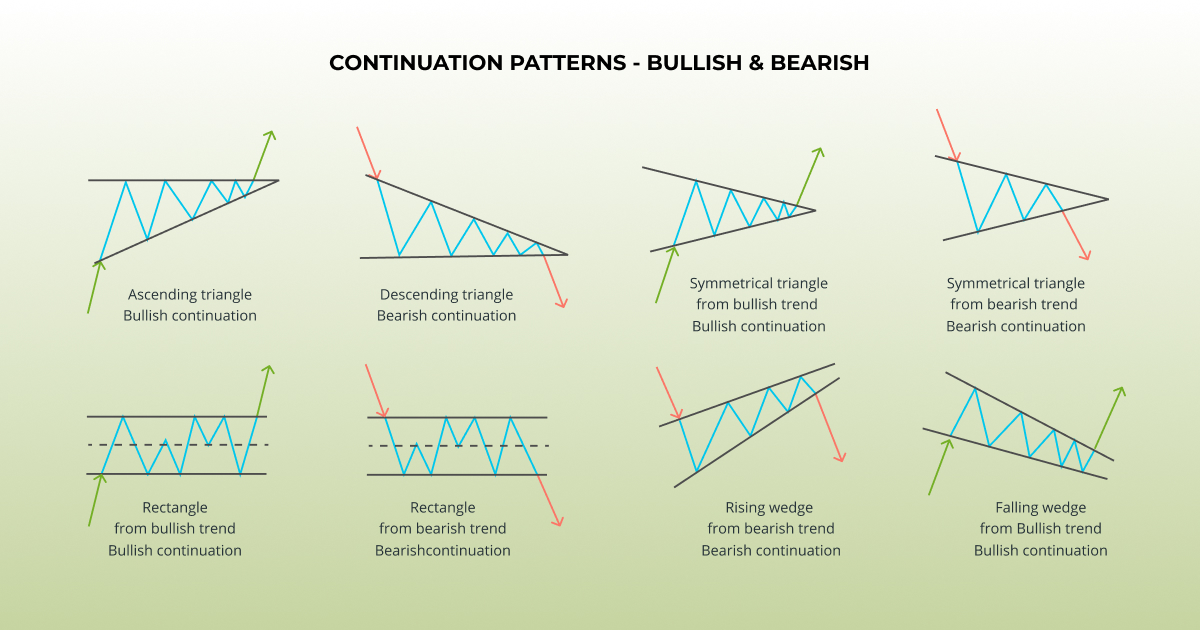

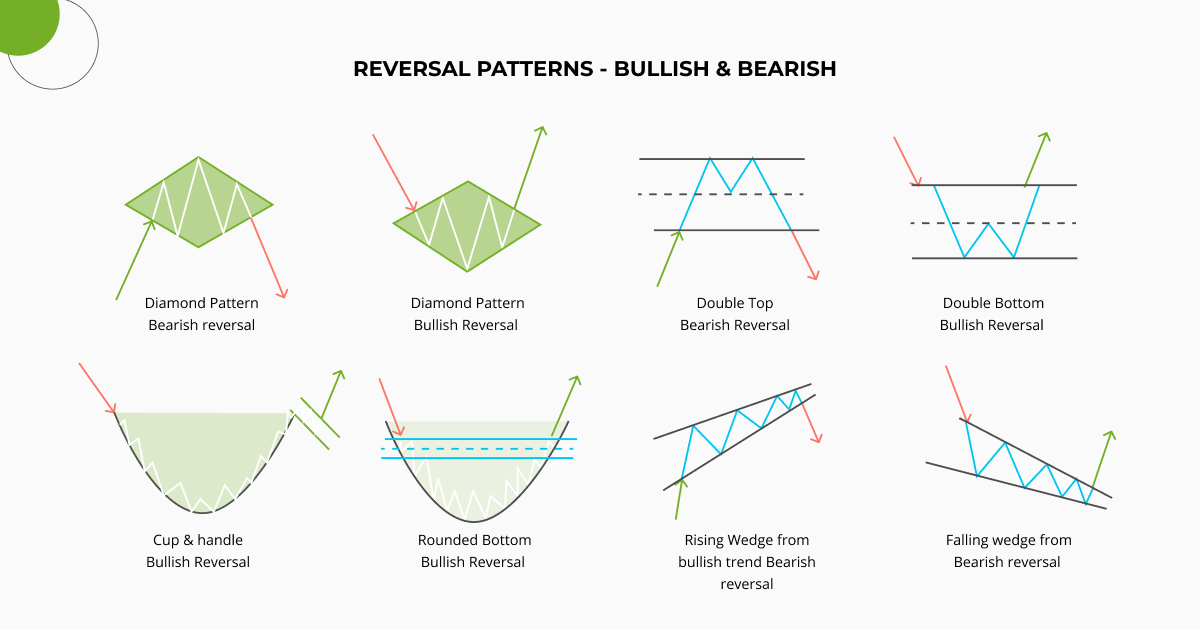

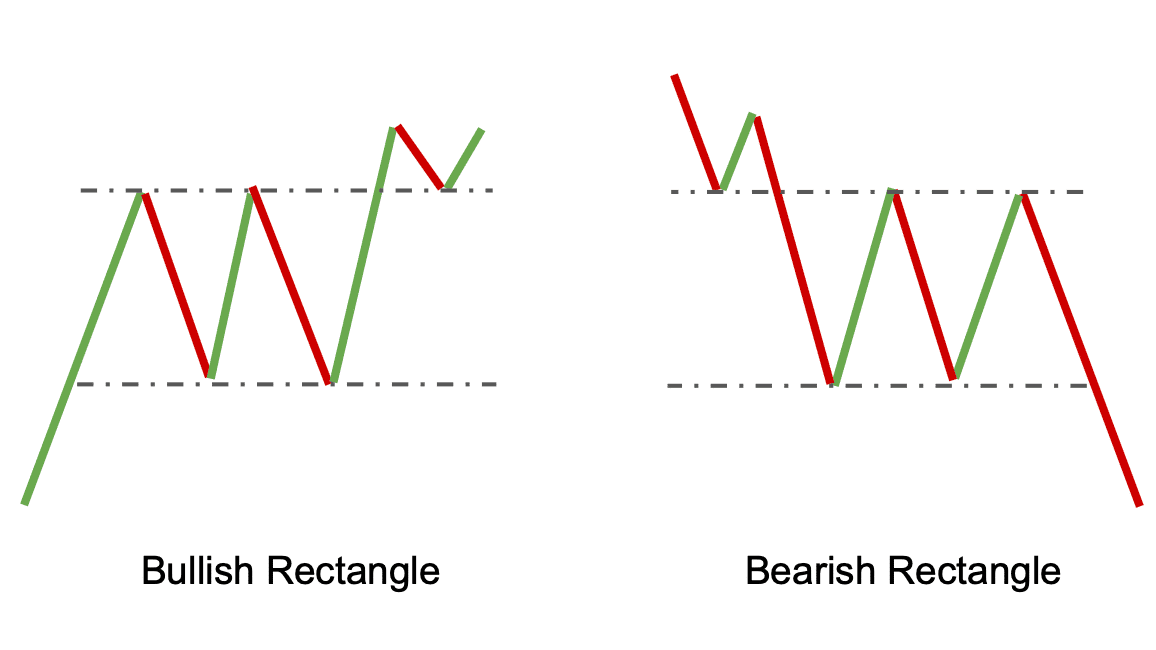

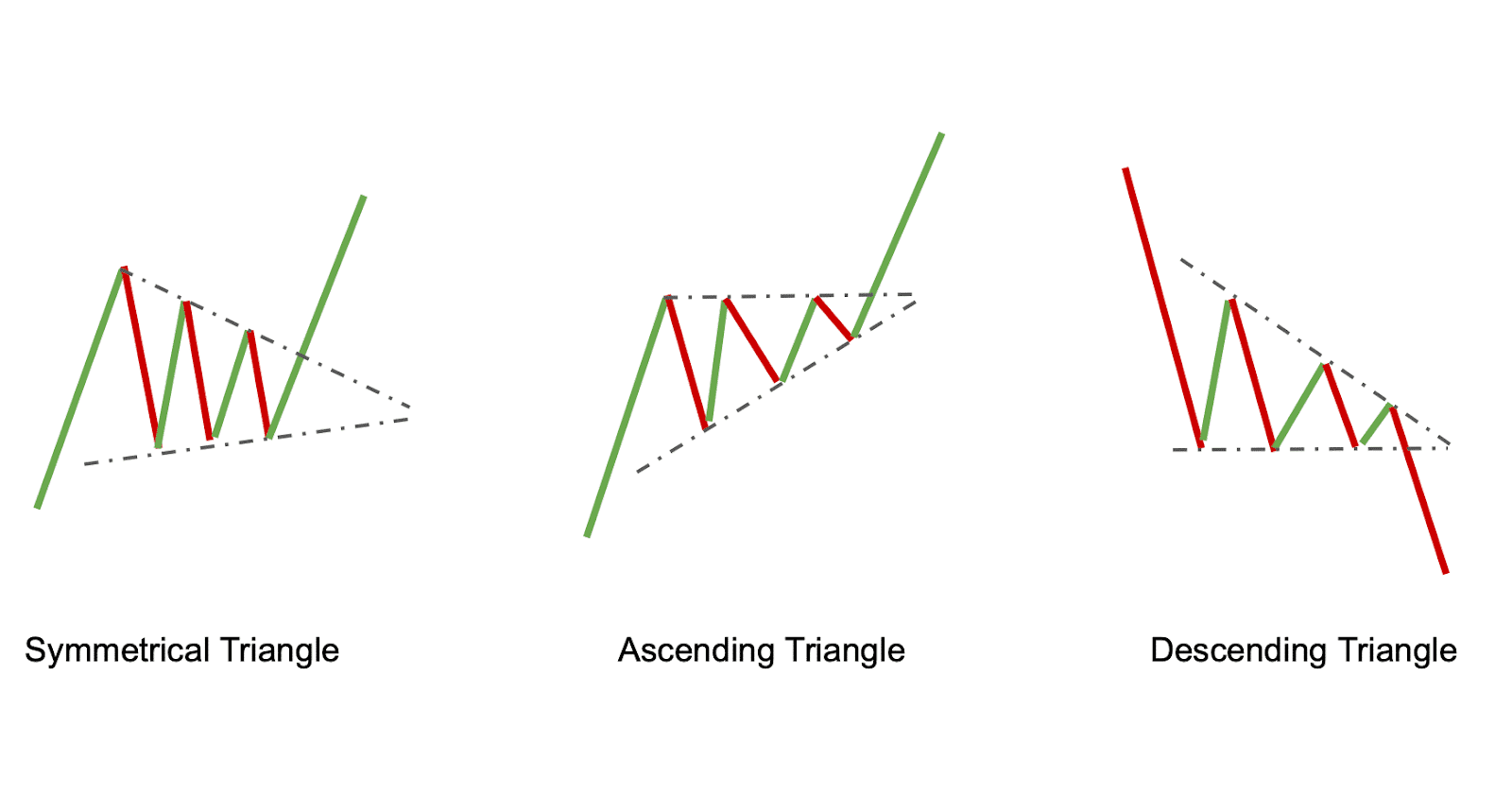

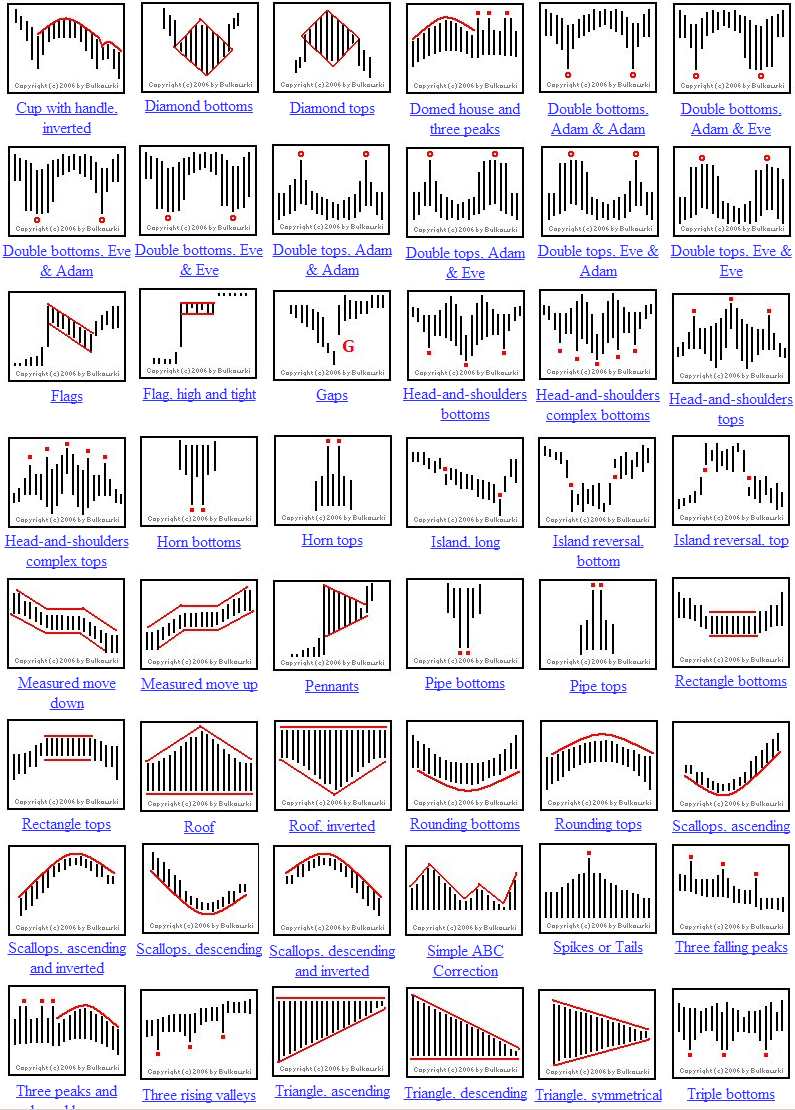

Crypto Chart Patterns - Success rates of various patterns. Triple & double tops and bottoms. Technical data showing a neutral mood and a fear & greed index value of 61 (greed. Web reading crypto charts is essential to anyone looking to trade digital assets. Web use this guide to help you earn money consistently from day trading crypto chart patterns accurately for profits. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. When prices ricochet off the same resistance (top) or support level. When analyzing a market, there are two primary methods used; The emergence of the pattern followed an 18%. Candlestick patterns such as the hammer, bullish harami, hanging man, shooting star, and doji can help traders identify potential trend reversals or confirm existing trends. Web to give a simple definition, crypto chart patterns are formations and trends, used in technical analysis to measure possible crypto price movements, which helps traders to make informed decisions about their next move or identify the best time to buy or sell opportunities in the market. When looking for trading opportunities, these chart formations are used to identify price trends, which indicate when traders should buy, sell, or hold. Web crypto trading patterns are chart formations of the price action of an asset. Line charts, bar charts, and candlestick charts. How to read crypto charts? Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. Which crypto assets are used for pattern recognition? Web crypto traders have identified a bullish pattern on the solana price chart, triggering anticipation for more rallies as solana’s price gained 17% in the past week. This guide deals with the technical aspect of chart analysis. The ability to assess price movements and recognise patterns in the charts is crucial to doing what in finance is called technical analysis. When price finally does break out of the price pattern, it can represent a significant change in sentiment. In most cases, hammer is one of the most bullish candlestick patterns in the market. Web doge market cap currently at $17.6 billion. The analysis also highlights a contradicting forecast that clouds jd’s hope. If you want to assess price trends from. Web doge market cap currently at $17.6 billion. When prices ricochet off the same resistance (top) or support level. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. Below are three examples to help you. The ability to assess price movements and recognise patterns in the. Technical data showing a neutral mood and a fear & greed index value of 61 (greed. These trend lines are crucial as the price often reacts to them as psychological barriers. Web crypto chart patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating candlestick patterns. Web candlestick charts are a. Web in this guide, we will break down these chart patterns into four categories: This guide deals with the technical aspect of chart analysis. Order book and market depth. Line charts, bar charts, and candlestick charts. Web crypto chart patterns. Web reading a crypto token chart is one of the most important skills to have when trading crypto. There are three common types of charts used by traders; Web in this guide, we will break down these chart patterns into four categories: Web crypto traders have identified a bullish pattern on the solana price chart, triggering anticipation for more rallies. Web 10 steps for how to trade crypto using chart patterns important tips on how to best use chart patterns for trading, including: How to crowdsource chart resources. Web as seen in the image above. If you want to assess price trends from a crypto chart, you will have to learn about the different types of charts. Technical data showing. Below are three examples to help you. Web candlestick charts are a popular tool used in technical analysis to identify potential buying and selling opportunities. Web crypto trading patterns frequently appear in crypto charts, leading to more predictable markets. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock. In most cases, hammer is one of the most bullish candlestick patterns in the market. Candlestick patterns such as the hammer, bullish harami, hanging man, shooting star, and doji can help traders identify potential trend reversals or confirm existing trends. Line charts, bar charts, and candlestick charts. How to crowdsource chart resources. Web chart patterns are formations that appear on. Web crypto chart patterns. Web to give a simple definition, crypto chart patterns are formations and trends, used in technical analysis to measure possible crypto price movements, which helps traders to make informed decisions about their next move or identify the best time to buy or sell opportunities in the market. Web crypto chart patterns appear when traders are buying. These patterns can indicate potential price movements. Web crypto traders have identified a bullish pattern on the solana price chart, triggering anticipation for more rallies as solana’s price gained 17% in the past week. Web crypto chart patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating candlestick patterns. How to. Web learn to spot flags, pennants, wedges and sideways trends and understand how those patterns can inform trading decisions. In most cases, hammer is one of the most bullish candlestick patterns in the market. Web doge market cap currently at $17.6 billion. Web 10 steps for how to trade crypto using chart patterns important tips on how to best use chart patterns for trading, including: Web crypto chart patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating candlestick patterns. Web crypto chart patterns are recognizable forms or shapes on a cryptocurrency’s price graph that traders use to study market psychology and predict the likelihood of future movements. When looking for trading opportunities, these chart formations are used to identify price trends, which indicate when traders should buy, sell, or hold. Web candlestick charts are a popular tool used in technical analysis to identify potential buying and selling opportunities. Downloadable cheat sheet (pdf) in this article, we cover the top 20 most common crypto chart patterns and what they mean. This guide deals with the technical aspect of chart analysis. These trend lines are crucial as the price often reacts to them as psychological barriers. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. The analysis also highlights a contradicting forecast that clouds jd’s hope. An example of a pennant formation. The emergence of the pattern followed an 18%. If you want to assess price trends from a crypto chart, you will have to learn about the different types of charts.Chart Patterns for Crypto Trading. Trading Patterns Explained (2022)

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Chart Patterns Cheat Sheet r/CryptoMarkets

Crypto Trading Patterns Cheat Sheet Cryptheory Just Crypto

Top Chart Patterns For Crypto Trading

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Top Chart Patterns For Crypto Trading Nomad Abhi Travel

Continuation Patterns in Crypto Charts Understand the Basics

Chart Styles in Crypto Trading Crypto Radio

Crypto Chart Pattern Explanation (Downloadable PDF)

When Prices Ricochet Off The Same Resistance (Top) Or Support Level.

Technical Data Showing A Neutral Mood And A Fear & Greed Index Value Of 61 (Greed.

These Patterns Can Indicate Potential Price Movements.

Web Reading A Crypto Token Chart Is One Of The Most Important Skills To Have When Trading Crypto.

Related Post: