Inverted Hammer Candlestick Pattern

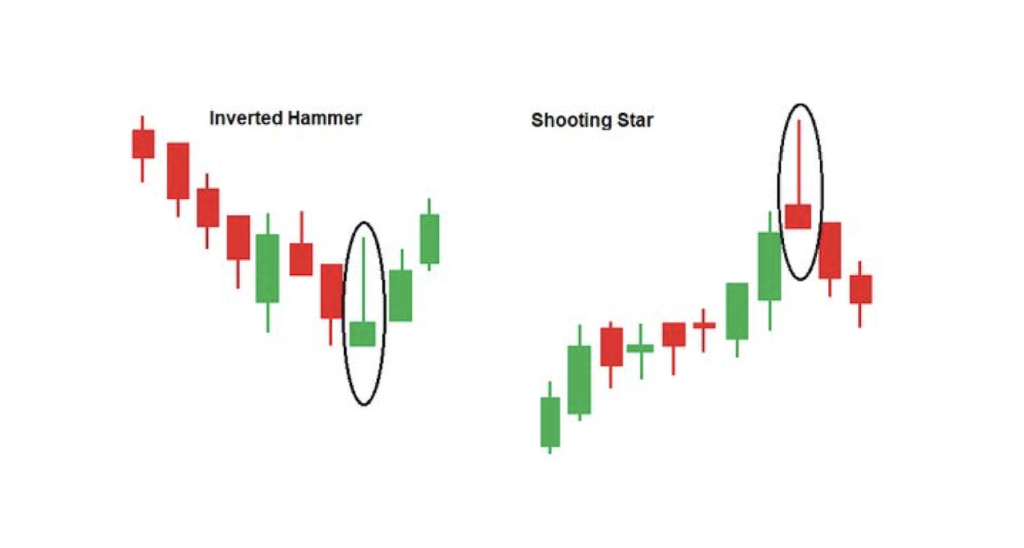

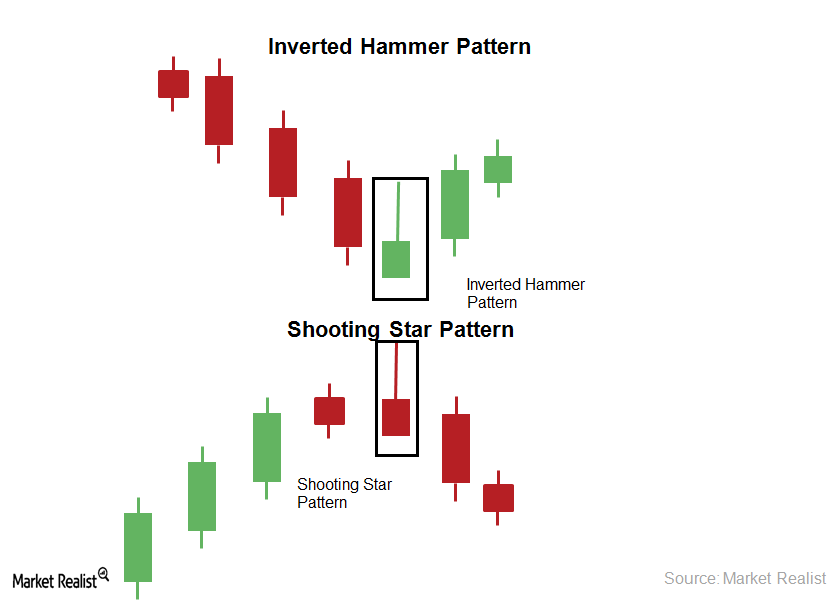

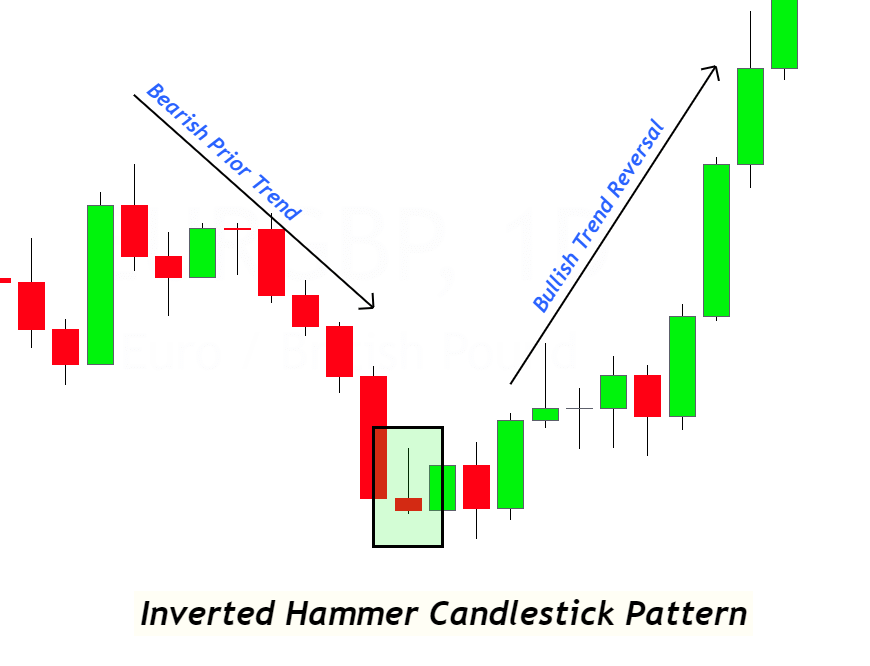

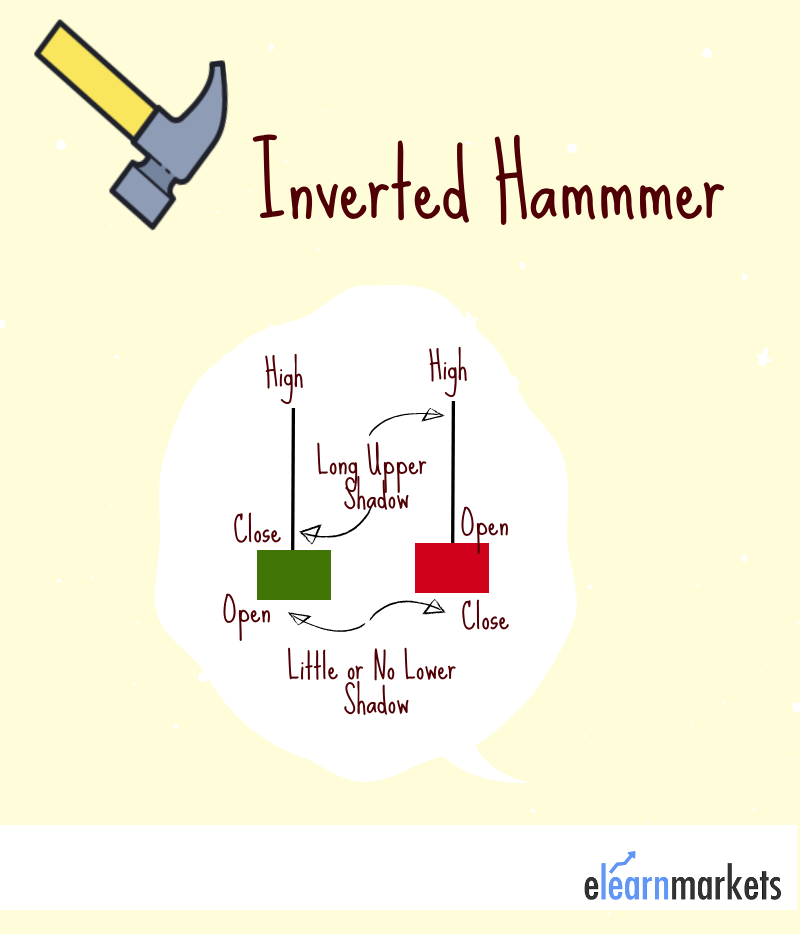

Inverted Hammer Candlestick Pattern - Variants of the inverted hammer candlestick pattern. How to identify the inverted hammer candlestick pattern. This is a reversal candlestick pattern that appears at the bottom of a downtrend and. A hammer pattern is a candlestick that has a long lower wick and a short body. The second candle is short and located in the bottom of the price range; Key tips to do better in trading with the inverted hammer. This specific pattern can act as a beacon, indicating potential price reversals. Web inverted hammer candlesticks are bullish candlestick patterns that form at the bottom of a downtrend, which signals a potential reversal. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how to trade on it. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price bottom followed by an upward move. Web what is the inverted hammer candlestick pattern. It signals a potential bullish reversal. Web the inverted hammer candlestick is a single candle pattern that signals a potential bullish reversal. The inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. Appears at the bottom of a downtrend. This specific pattern can act as a beacon, indicating potential price reversals. What is an inverted hammer candlestick? How to use the inverted hammer candlestick pattern in trading? This is a reversal candlestick pattern that appears at the bottom of a downtrend and. Web what is an inverted hammer pattern? The inverted hammer candlestick pattern is recognized if: Web inverted hammer is a single candle which appears when a stock is in a downtrend. Web the hammer is a bullish reversal pattern, which signals that a stock is nearing the bottom in a downtrend. Web how to spot an inverted hammer candlestick pattern: Pros and cons of the inverted hammer candlestick; The inverted hammer candlestick pattern is recognized if: That is why it is called a ‘bullish reversal’ candlestick pattern. Web an inverted hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure to push the price of the stocks upwards. Web the hammer candlestick as shown. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. That is why it is called a ‘bullish reversal’ candlestick pattern. Web what is an inverted hammer candlestick pattern? Web what is the inverted hammer candlestick pattern. Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend. A long lower shadow, typically two times or more the length of the body. Web the inverted hammer candlestick is a single candle pattern that signals a potential bullish reversal. Learn how to critically identify such trends. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies. That is why it is called a ‘bullish reversal’ candlestick pattern. Web the hammer is a bullish reversal pattern, which signals that a stock is nearing the bottom in a downtrend. The body of the candle is short with a longer lower shadow. What is an inverted hammer candlestick? Learn how to critically identify such trends. An inverted hammer is one of the most common candlestick patterns. Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate enough pressure to drive up an asset’s price. Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find. How to trade the inverted hammer candlestick pattern. Web what is the inverted hammer candlestick pattern. Web inverted hammer candlesticks are bullish candlestick patterns that form at the bottom of a downtrend, which signals a potential reversal. Web what is an inverted hammer candlestick pattern? Web what is an inverted hammer pattern in candlestick analysis? Typically, it will have the following characteristics: Web what is an inverted hammer candlestick pattern? Strategies to trade the inverted hammer candlestick pattern. How to trade the inverted hammer candlestick pattern. Usually, one can find it at the end of a downward trend; Web understanding how inverted hammer candlestick patterns help you make better decisions in a trade. How to identify the inverted hammer candlestick pattern. Web in forex trading, the inverted hammer candlestick pattern holds significant importance. What is a hammer candlestick pattern? This specific pattern can act as a beacon, indicating potential price reversals. Web in forex trading, the inverted hammer candlestick pattern holds significant importance. This specific pattern can act as a beacon, indicating potential price reversals. Web how to spot an inverted hammer candlestick pattern: That is why it is called a ‘bullish reversal’ candlestick pattern. How to use the inverted hammer candlestick pattern in trading? The inverse hammer candlestick and shooting star patterns look identical but are found in different areas. The inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. Candle with a small real body, a long upper wick and little to no lower wick. The inverted hammer candlestick pattern is recognized if: Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. With little or no upper wick, a hammer candlestick should resemble a hammer. Web what is the inverted hammer? Typically, it will have the following characteristics: Web what is an inverted hammer pattern in candlestick analysis? Learn how to critically identify such trends. It signals a potential bullish reversal. Appears at the bottom of a downtrend. Web the inverted hammer candlestick is a single candle pattern that signals a potential bullish reversal. Web how to spot an inverted hammer candlestick pattern: Web what is the inverted hammer candlestick pattern.Understanding the Inverted Hammer Candlestick Pattern Premium Store

Understanding the Inverted Hammer Candlestick Pattern Premium Store

Inverted Hammer Candlestick Pattern (Bullish Reversal)

Inverted Hammer Candlestick Pattern Quick Trading Guide

The Inverted Hammer And Shooting Star Candlestick Pattern

How to Read the Inverted Hammer Candlestick Pattern? (2022)

Inverted Hammer Candlestick Pattern Forex Trading

Bullish Inverted Hammer Candlestick Pattern ForexBee

Inverted Hammer Candlestick How to Trade with this Pattern

Inverted Hammer Candlestick Pattern PDF Guide Trading PDF

How To Use The Inverted Hammer Candlestick Pattern In Trading?

Web An Inverted Hammer Candlestick Is A Pattern That Appears On A Chart When There Is A Buyer’s Pressure To Push The Price Of The Stocks Upwards.

Pros And Cons Of The Inverted Hammer Candlestick;

Both Are Reversal Patterns, And They Occur At The Bottom Of A Downtrend.

Related Post: