Reverse Head Shoulders Pattern

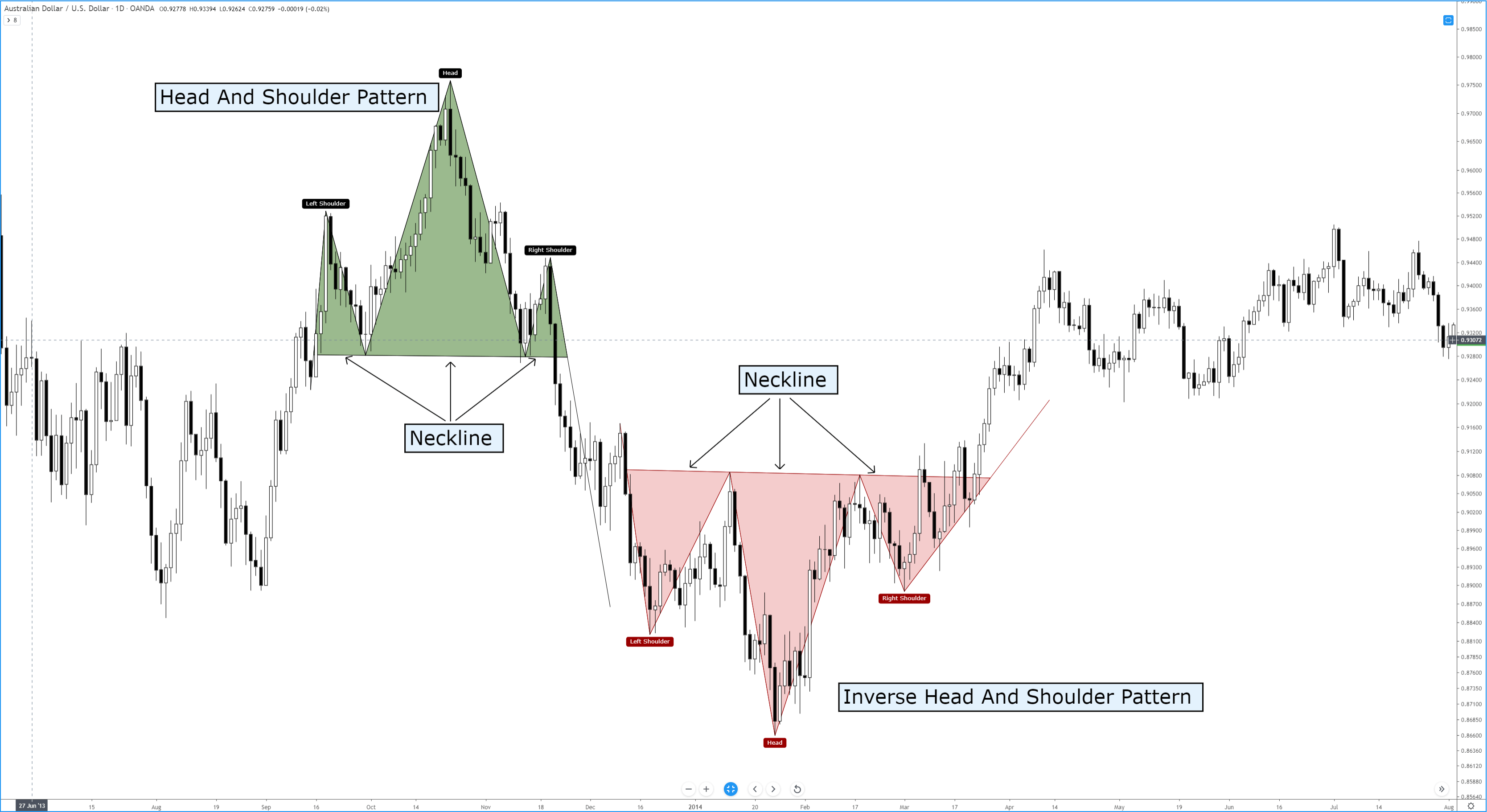

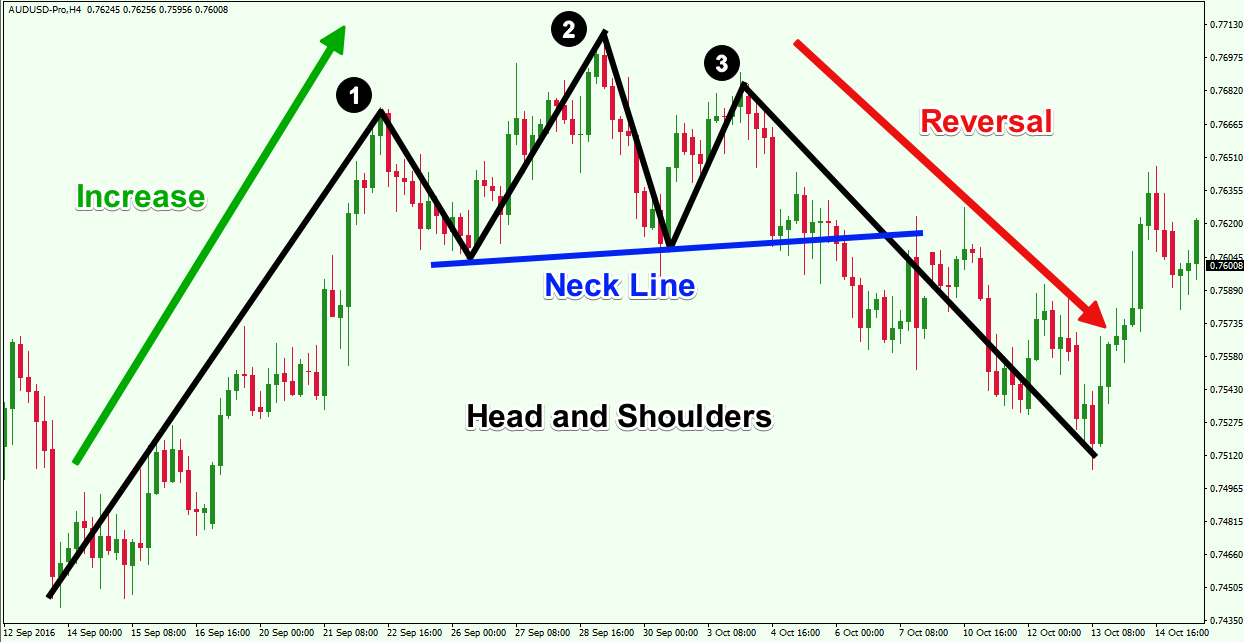

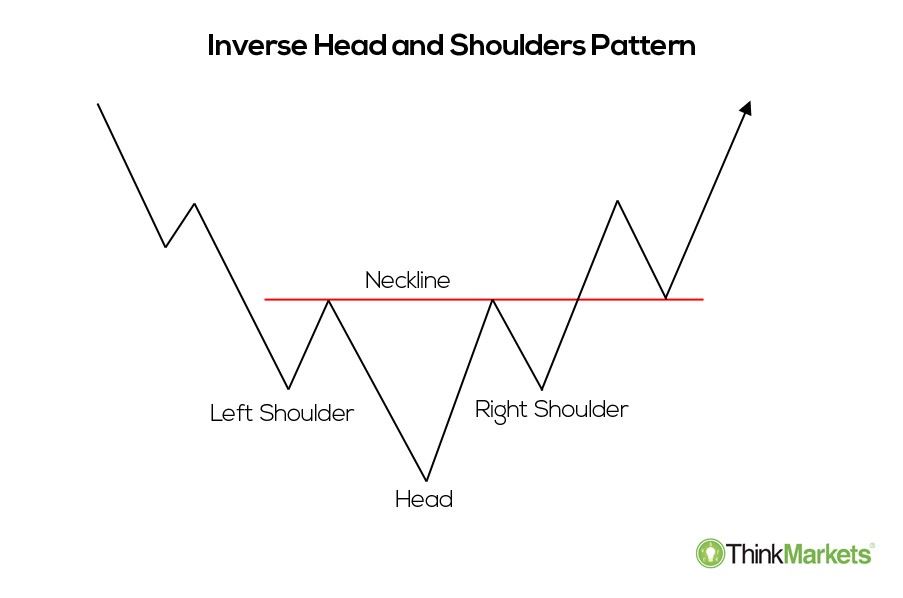

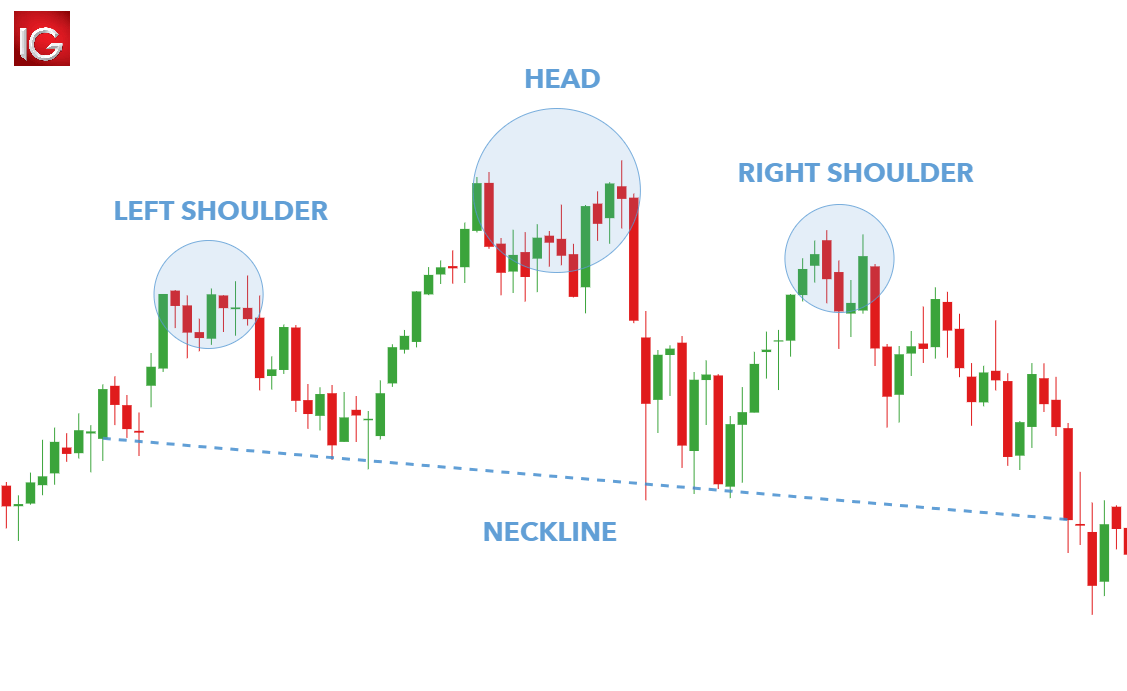

Reverse Head Shoulders Pattern - It has three distinctive parts: Web the head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. Historical pricing feeds the technical indicator and investors and analysts frequently use it to determine if a downward tendency is probable. Web the inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). The first and third lows are called shoulders. Head & shoulder and inverse head & shoulder. Both “inverse” and “reverse” head and shoulders patterns are the same. Web what is the inverse head and shoulders? Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. It is of two types: Web what is the inverse head and shoulders pattern? The components of a head and shoulders trading pattern. The inverse head and shoulders pattern is a reversal pattern in stock trading. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. This reversal could signal an. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Historical pricing feeds the technical indicator and investors and analysts frequently use it to determine if a downward tendency is probable. Read about head and shoulder pattern here: The left shoulder forms when investors pushing a stock higher temporarily lose enthusiasm. “head and shoulder bottom” is also the same thing. The left shoulder, head, and right shoulder. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. It is the opposite of the head and shoulders chart pattern,. It is of two types: Analysts often use the chart for stocks, but also for trading in forex, commodities, and. It has three distinctive parts: Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself. It's one of the most reliable trend reversal patterns. The right shoulder. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web inverse head and. Web what is the inverse head and shoulders? The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Inverse h&s pattern is bullish reversal pattern. It's one of the most reliable trend reversal patterns. It has three distinctive parts: Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and shoulders stock pattern in. Read about head and shoulder pattern here: This reversal could signal an. It is the opposite. It is the opposite of the head and shoulders chart pattern,. The left shoulder, head, and right shoulder. Volume play a major role in both h&s and inverse h&s patterns. This reversal could signal an. Web the inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). Web an inverse head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from a downtrend to an uptrend. Inverse h&s pattern is bullish reversal pattern. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself.. The inverse head and shoulders pattern is a bullish reversal pattern. Following this, the price generally goes to the upside and starts a new uptrend. The pattern resembles the shape of a person’s head and two shoulders in an inverted position, with three consistent lows and peaks. The left shoulder forms when the price falls to a new low, followed. The inverse head and shoulders pattern is a bullish reversal pattern. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web what is the inverse head and shoulders? The components of a head and shoulders trading pattern. Web inverted head and shoulders. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. The. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself. Web the inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). The inverse head and shoulders pattern is a reversal pattern in stock trading. Volume play a major role in both h&s and inverse h&s patterns. The height of the pattern plus the breakout price should be your target price using this indicator. It is the opposite of the head and shoulders chart pattern,. The left shoulder, head, and right shoulder. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. Analysts often use the chart for stocks, but also for trading in forex, commodities, and. The inverse head and shoulders pattern is a bullish reversal pattern. The left shoulder forms when the price falls to a new low, followed by a pullback. Web what is the inverse head and shoulders pattern? The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Web what is the inverse head and shoulders? Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. It's one of the most reliable trend reversal patterns.Head and Shoulders Trading Patterns ThinkMarkets EN

The Head and Shoulders Pattern A Trader’s Guide

Reverse Head And Shoulders Pattern Stocks

Reverse Head And Shoulders Pattern (Updated 2022)

Must be Profit if you identify Resistance and Support Line (Part13

Inverse Head And Shoulders Pattern [2023 Update] Daily Price Action

Chart Patterns The Head And Shoulders Pattern Forex Academy

Inverse Head and Shoulders Chart Pattern in 2020 Trading charts

headandshouldersreversalchartpattern Forex Training Group

How To Trade Blog What is Inverse Head and Shoulders Pattern

Inverse H&S Pattern Is Bullish Reversal Pattern.

The Left Shoulder Forms When Investors Pushing A Stock Higher Temporarily Lose Enthusiasm.

However, If Traded Correctly, It Allows You To Identify High Probability Breakout Trades, Catch The Start Of A New Trend, And Even “Predict” Market Bottoms Ahead Of Time.

The Pattern Resembles The Shape Of A Person’s Head And Two Shoulders In An Inverted Position, With Three Consistent Lows And Peaks.

Related Post:

![Inverse Head And Shoulders Pattern [2023 Update] Daily Price Action](https://dailypriceaction.com/wp-content/uploads/2015/03/4-hour-inverse-head-and-shoulders-confirmed.png)