Stock Triangle Pattern

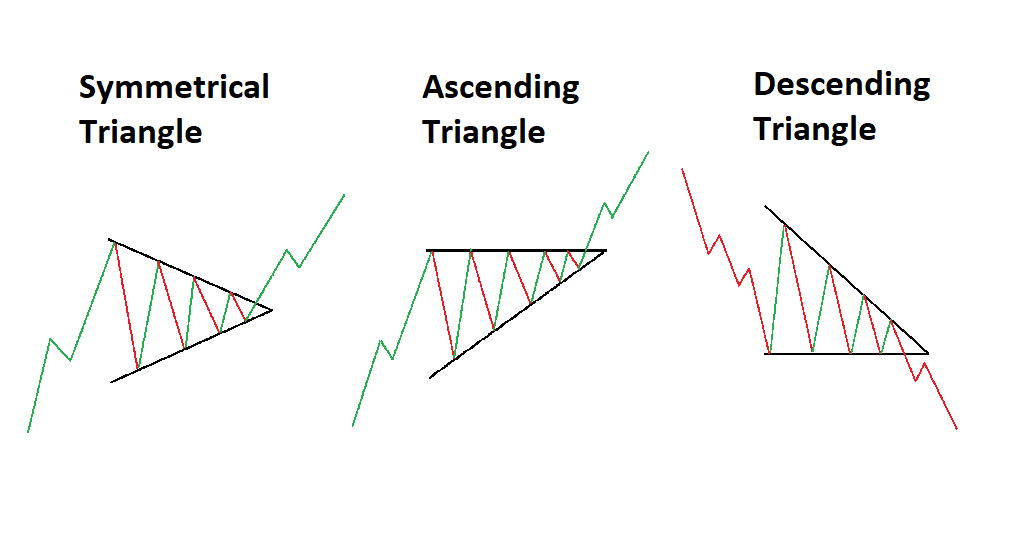

Stock Triangle Pattern - Web there are basically 3 types of triangles and they all point to price being in consolidation: Good volume buildup can also be visible for several weeks. However, traders should be aware that the triangle pattern can also be a trap for unsuspecting beginners. Web ascending triangle trading chart patterns are some of the most widely used stock market patterns. I only trade the triangle pattern in strong stocks. Web ascending triangles and descending triangle chart patterns are some of the best chart patterns for new day traders looking to use technical analysis. Web a triangle pattern forms when a stock’s trading range narrows following an uptrend or downtrend, usually indicating a consolidation, accumulation, or distribution before a continuation or reversal. The stock broke out from a symmetrical triangle, a chart pattern that. Strong bullish candlestick form on this timeframe. The pattern derives its name from the fact that it is characterized by a contraction in price range and converging trend lines, thus giving it a triangular shape. Web a triangle pattern is a chart pattern that denotes a pause in the prevailing trend and is represented by drawing trendlines along a converging price range. The target price level depends on the direction in which the price broke this pattern. However, traders should be aware that the triangle pattern can also be a trap for unsuspecting beginners. Web whether bullish or bearish, a descending triangle pattern is a tried and tested approach that helps traders make more informed, consistent, and ultimately, profitable trades. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an ascending trend line acting as support) and descending (price is contained by a horizo. The stock broke out from a symmetrical triangle, a chart pattern that. The rectangle top is the most profitable, with an average win of 51%, followed by the rectangle bottom with 48%. Technical analysts and chartists seek to identify patterns. Web triangles within technical analysis are chart patterns commonly found in the price charts of financially traded assets ( stocks, bonds, futures, etc.). Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom and descending triangle (87%). Bata india ltd key highlights: Web in technical analysis, a triangle is a common chart pattern that signifies a period of consolidation in the price of an asset. Web triangle patterns are one of my favorite stock swing trading strategies. I only trade the triangle pattern in strong stocks. Web a triangle chart pattern forms when the trading range of. Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. These naturally occurring price actions indicate a pause or consolidation of prices and signal a potential trend continuation or reversal, depending on which side the price breaks out. Web there are basically 3 types of triangles and they. Web ascending triangle trading chart patterns are some of the most widely used stock market patterns. What is a descending triangle pattern? Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Strong bullish candlestick form on this timeframe. The rectangle top is. While triangles are a common chart pattern, i require very specific criteria to materialize in order for me to take a trade. Strong bullish candlestick form on this timeframe. Web triangles within technical analysis are chart patterns commonly found in the price charts of financially traded assets ( stocks, bonds, futures, etc.). Good volume buildup can also be visible for. ⚡️ on 1 hour time frame stock showing breakout of symmetrical triangle pattern. However, traders should be aware that the triangle pattern can also be a trap for unsuspecting beginners. Web in technical analysis, a triangle is a common chart pattern that signifies a period of consolidation in the price of an asset. Web traders use triangles to highlight when. These naturally occurring price actions indicate a pause or consolidation of prices and signal a potential trend continuation or reversal, depending on which side the price breaks out. A descending triangle pattern is a price chart formation used in technical analysis. They are considered bullish chart patterns that reveal to a trader that a breakout is likely to occur at. Web whether bullish or bearish, a descending triangle pattern is a tried and tested approach that helps traders make more informed, consistent, and ultimately, profitable trades. Web ascending triangle trading chart patterns are some of the most widely used stock market patterns. Web a triangle pattern forms when a stock’s trading range narrows following an uptrend or downtrend, usually indicating. Web a triangle is an indefinite pattern that can herald both an increase and a fall in price. Web a triangle pattern forms when a stock’s trading range narrows following an uptrend or downtrend, usually indicating a consolidation, accumulation, or distribution before a continuation or reversal. It is formed by drawing two converging trendlines, creating a shape that resembles a. Web a triangle is an indefinite pattern that can herald both an increase and a fall in price. Technical analysts and chartists seek to identify patterns. Web triangle patterns can be bullish, bearish or inconclusive. What is a descending triangle pattern? Web a pattern is identified by a line connecting common price points, such as closing prices or highs or. Web shares in berkshire hathaway closed at a record high on monday, buoyed by gains in some of the conglomerate’s key holdings. Web triangles within technical analysis are chart patterns commonly found in the price charts of financially traded assets ( stocks, bonds, futures, etc.). Triangles are similar to wedges and pennants and can be either a continuation pattern, if.. There are three potential triangle variations that can develop as. The target price level depends on the direction in which the price broke this pattern. Web the triangle pattern is a popular chart pattern that is often used by technical analysts to identify potential breakout opportunities. It can give movement up to the breakout target of 1600+. Good volume buildup can also be visible for several weeks. Web a triangle is an indefinite pattern that can herald both an increase and a fall in price. A descending triangle is indicated by lower highs. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. A descending triangle pattern is a price chart formation used in technical analysis. Web triangle patterns can be bullish, bearish or inconclusive. Web triangles within technical analysis are chart patterns commonly found in the price charts of financially traded assets ( stocks, bonds, futures, etc.). Triangles are similar to wedges and pennants and can be either a continuation pattern, if. Web a triangle chart pattern forms when the trading range of a financial instrument, for example, a stock, narrows following a downtrend or an uptrend. Such a chart pattern can indicate a trend reversal or the continuation of a trend. The stock broke out from a symmetrical triangle, a chart pattern that. I use the two terms interchangeably.3 Triangle Patterns Every Forex Trader Should Know

How to Trade Triangle Chart Patterns FX Access

Triangle Pattern Characteristics And How To Trade Effectively How To

Triangle Chart Patterns A Guide to Options Trading

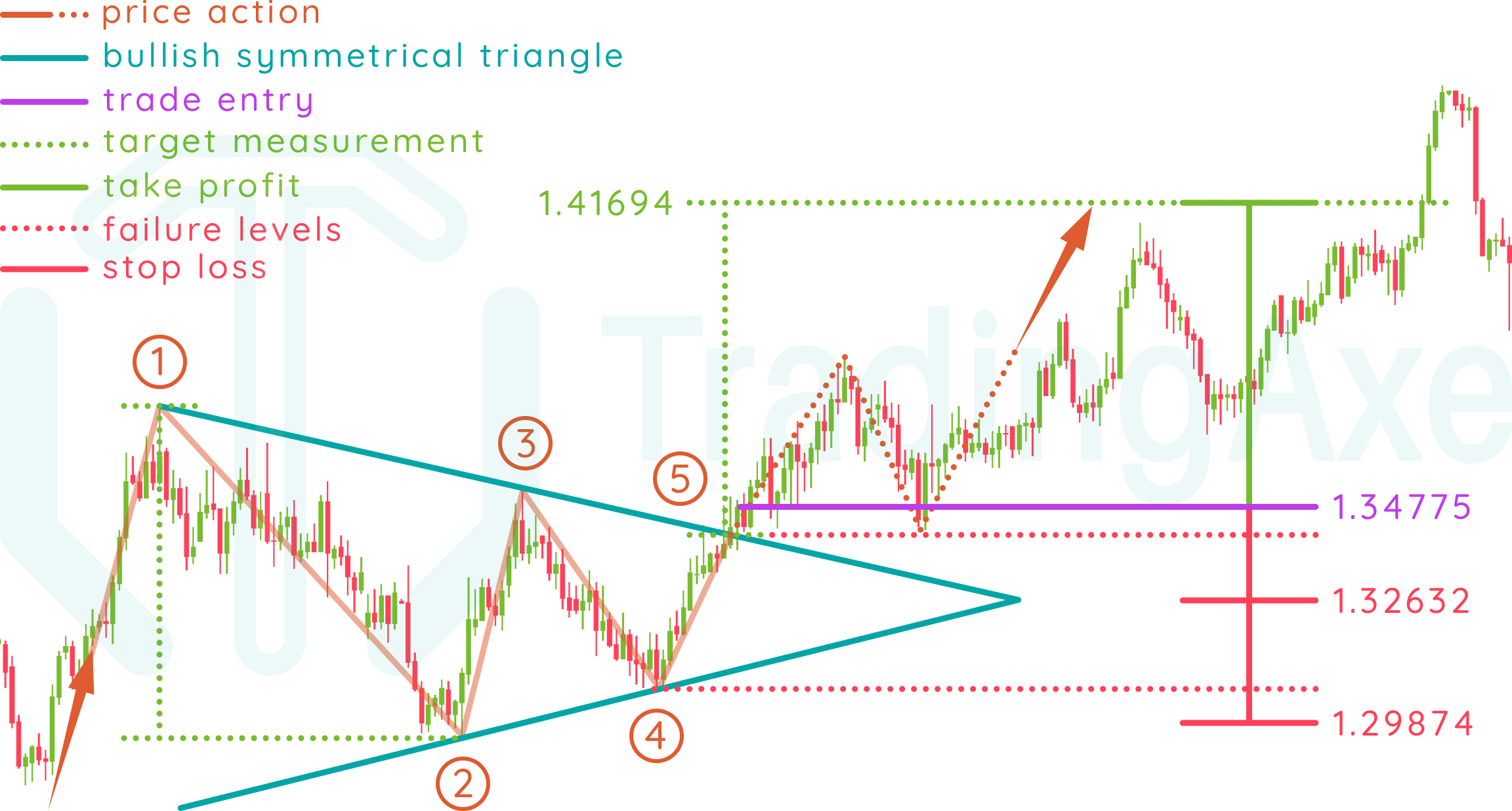

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

Triangle Chart Patterns Complete Guide for Day Traders

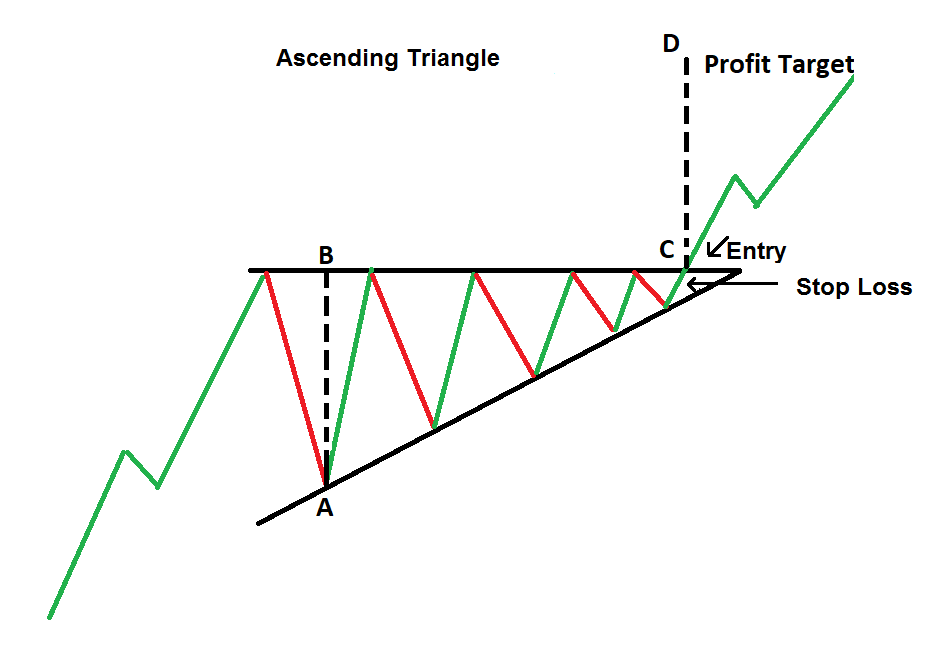

The Ascending Triangle Pattern What It Is, How To Trade It

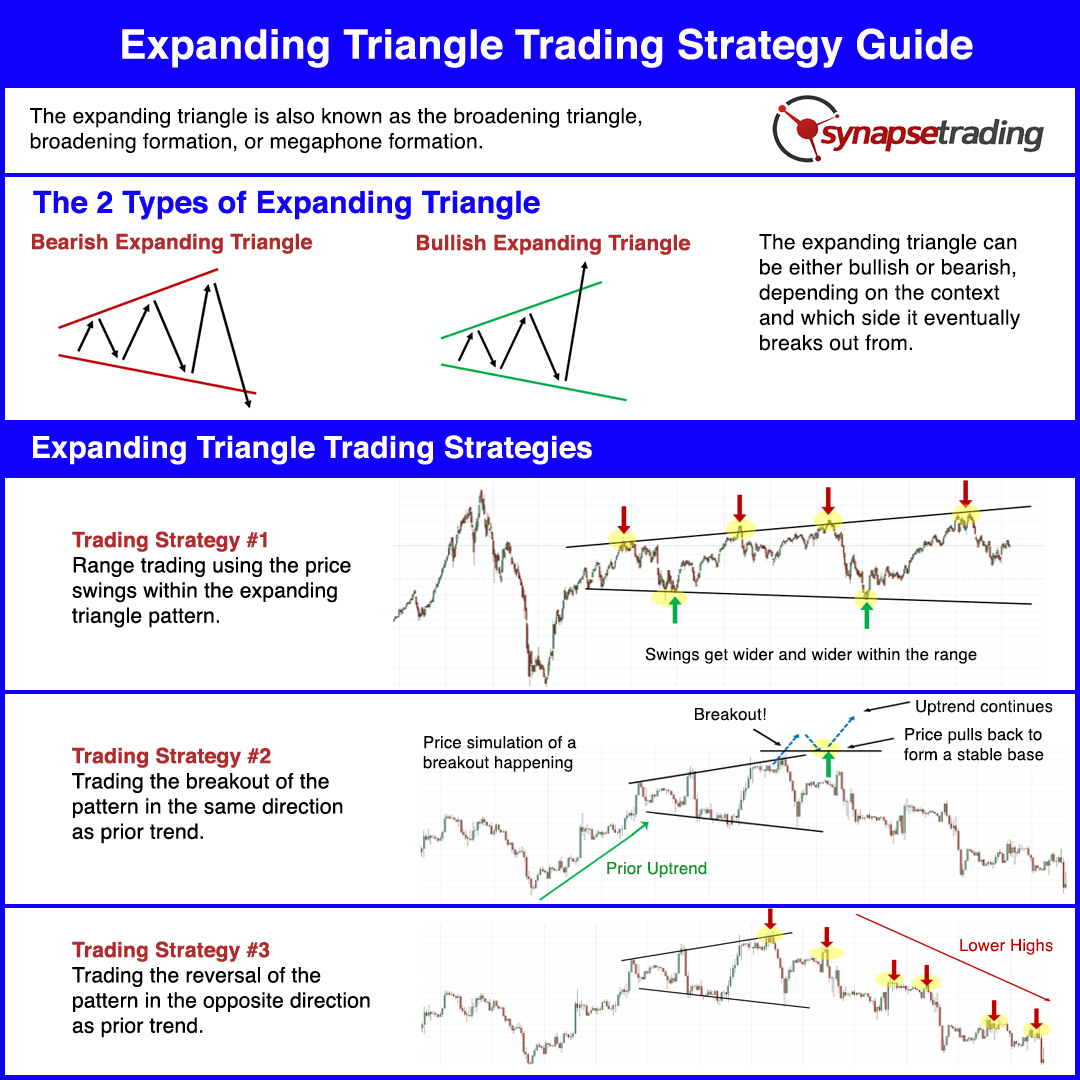

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Ascending and Descending Triangle Patterns Investar Blog

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

These Naturally Occurring Price Actions Indicate A Pause Or Consolidation Of Prices And Signal A Potential Trend Continuation Or Reversal, Depending On Which Side The Price Breaks Out.

Strong Bullish Candlestick Form On This Timeframe.

Entry Can Be Made Upon Breaking The Previous Day's High Levels Of 1739.

Web Here Are Two Day Trading Strategies For Three Types Of Triangle Chart Patterns, Including How To Enter And Exit Trades And How To Manage Risk.

Related Post:

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns1-bba0f7388b284f96b90ead2b090bf9a8.png)